Apr 2021

Apr 2021

Weekly markets round-up

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold remained relatively resilient over the past week, reaching eight-week highs and testing $1,800/ounce, although there was one slip last Friday as the dollar rebounded – briefly – on the back of stronger new home sales figures than the market had been expecting. The physical market has continued to improve in south-east Asia, although the sad developments in India, with the virus taking hold again, have put that market’s recovery on hold. Coin demand remains very strong, especially in America, with a number of mints around the world on allocation and a few unable to keep up with demand.

The latest figures from the U.S. Mint, for example, suggest that demand has faded; we suspect that in fact it may be more a case of tightness in supply in the face of strong buying interest; premia have been very high, but this does not appear to be deterring buyers.

On another side of the market, gold exchange traded products continue to lose metal, although the pace of redemptions has slowed substantially. In January the gold ETPs were virtually unchanged and then as the bond market took fright, expecting an inflationary recovery in the U.S. economy, gold lost some of its appeal and 124t left the funds. March was much the same in terms of sentiment so as the physical regional demand markets were improving, the ETFs lost 135t of metal. In the first three weeks of April, however, the reduction has been much slower at 20 tonnes (and last week there was one day when holdings actually increased, albeit very marginally), leaving total holdings currently at 3,553 tonnes, which at $1,780 is worth $203Bn. To put this in context, world mine production is in the region of 3,500 tonnes per annum.

Sentiment in the bond market has changed slightly, and market opinions are currently mixed about the outlook for the dollar. Bears are concentrating on the stance of the Federal Reserve, which holds its third Open Market Committee policy meeting this week and is fully expected to adhere to its stance of lower-for-longer with respect to interest rates; of more interest is what the Board will say about the possibility of tapering later this year (i.e. reducing the rate of asset purchases from the current $120Bn per month); while bulls are pointing, among other things, to the likelihood of more strong economic data this week and the continued problems in Europe. Behind this is the high rate of vaccinations in the United States, compared with the much more sluggish roll-out in Europe. This week sees a lot of economic numbers around the world, notably GDP and CPI rates, while the reporting season for equities in the United States gets into full swing. To that end we should probably expect a cautious gold market to start with. Unless there are any major surprises gold is likely to continue to test $1,800, although there are signs of mine hedge-related selling into attempts on that level.

Gold and the U.S. ten-year note position on CBT; note the short covering in early April

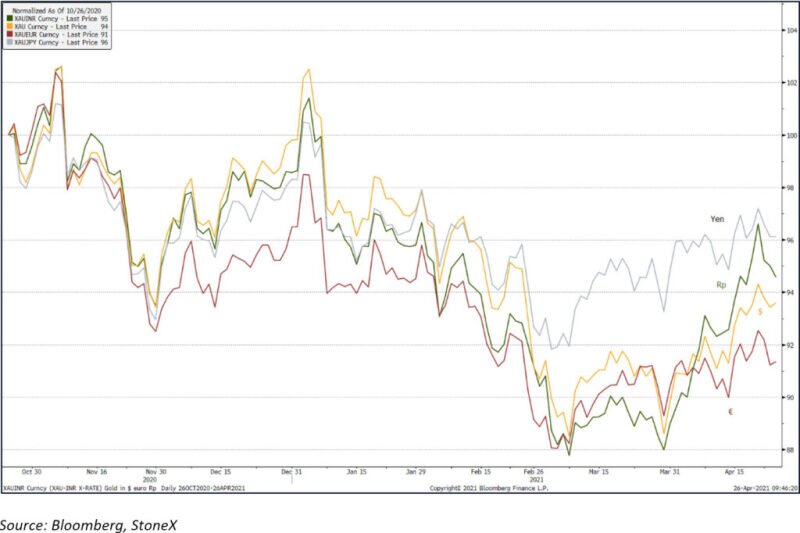

Gold in dollars, euro, yen and rupee; six-month view