Jan 2022

Jan 2022

That didn’t last long…

By StoneX Bullion

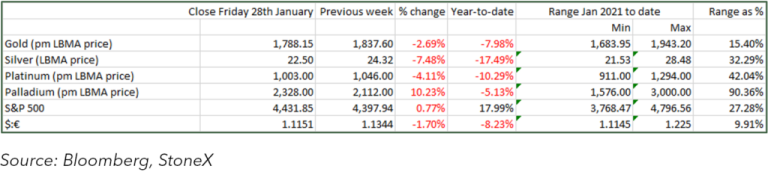

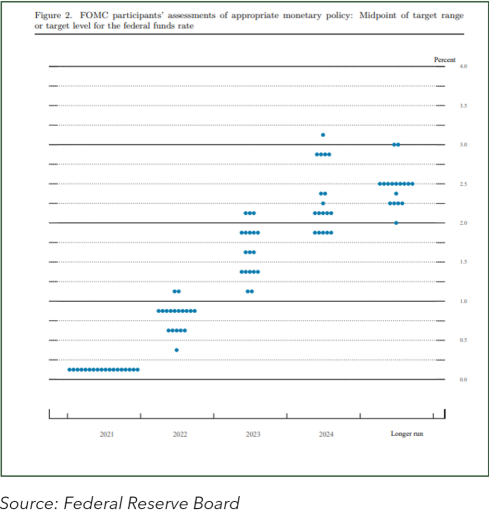

After showing signs of fresh strength two weeks ago, gold crumbled last week in response to a more hawkish outcome of the Federal Open Market Committee than the markets had been expecting, although it is certainly arguable that the bond markets overreacted by starting to price in the prospect of five interest rate hikes in the United States this year. We take the view that it’s not so much the number of hikes that the FOMC puts through, it’s the cumulative level that counts. The most recent “dot plot” is shown below and shows that the majority of participants were expecting the lower end of the fed funds target rate to be between 75 and 100 basis points by the end of this year. That is the equivalent of three 25 basis point hikes, por possibly one of 50 and one of 25. We suspect that this may be more hawkish when the next one is released (16th March) and may well point to a full 1% increase in the rate by year-end.

In principle the FOMC Statement and Jay Powell’s Press Conference weren’t that much more hawkish than previously, but it was noticeable that in the Press Conference he made quite a lot of use of the word “strong”, while in the statement the Committee said that it would “soon” be appropriate to raise the fed funds target. Also, the Committee released a document showing the Principles for reducing the size of the balance sheet, in which the first principle is that changes in the fed funds target rate will remain the primary tool, while the balance sheet declines [in the background] in a predictable manner. SO we should have the fed funds working hand-in-hand with the reduction of the balance sheet (i.e. not reinvesting bonds the money generated by bonds as they mature); it is possible, that this could mean (and it is only “could” give the Fed more flexibility with the fed funds target rate and they may even be able to adopt a more benign policy than the markets are currently expecting.

The December 2021 dot plot

This of course all depends on economic performance (and by association the control of the COVID-19 virus and its variants). The U.S. economy has hit a bit of a flat spot at the moment. For example, the University of Michigan sentiment reading last week saw consumer sentiment down to 67.2, which is the lowest January reading in 13 years and the lowest since August 2011. Inflationary expectations, however, stayed pretty steady at 4.9% for this year and down to 3.1% for the longer term, which is encouraging.

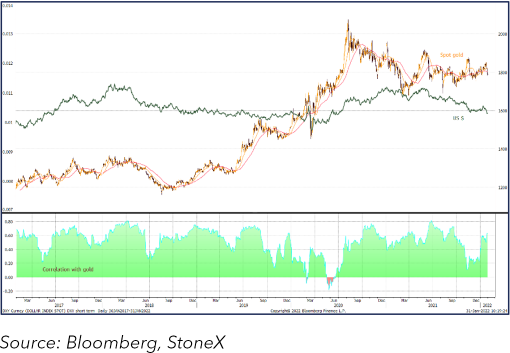

Gold, the ten-year U.S. yield and their correlation

That moderate longer-term inflationary expectation may have added to gold’s price fall. The recoil from levels above $1,840 had actually started before the outcome of the FOMC meeting (triggered by the slippage through the 20-day moving average, which itself was crossing the 50-day to the downside, putting independent pressure on the price. The move accelerated thereafter in U.S. trading hours and kept going until the end of the week, by which stage, at $1,780, it was oversold and ready for a correction. As we write the price is hovering around $1,790 and has again pushed above those two key moving averages. The key drivers behind the price at present are the strength or otherwise of the dollar, and, probably more importantly, the relationship with the ten-year bond. In nominal terms the ten-year yield is 1.61%, but the December 2021 CPI figure was 7.5%, which puts the real ten-year yield firmly in negative territory and it is likely to stay that way for a good while.

This real rate argument will help to appeal to the institutional investors, while retail demand remains strong, largely on the basis of outright inflation levels. The latest Commitment of Traders report from the CFTC show that in the week to last Tuesday 25th both gold and silver prices were boosted by substantial short covering from the Managed Money sector. It would not be at all surprising to see fresh shorts established in the week to this Tuesday 1st February.

Gold in USD, EUR and YEN

Gold and the Inverse of the Dollar