Dec 2021

Dec 2021

Silver under pressure

By StoneX Bullion

As ever, the news from the Federal Reserve has been a key element in the precious metals markets over the past week, with Fed Chair Jay Powell’s testimony to Congress capturing the financial markets’ attention all round. On Tuesday he testified before the House Banking Committee (and the same testimony was delivered on Wednesday to the Senate) in which he shifted his stance on inflation. For some months he had been arguing that inflationary forces are transitory due to supply chain dislocations but is now arguing that these forces are probably more persistent than previously expected. He alluded to the possibility that the Fed would accelerate its unwinding of the asset purchase programme and that the rebalancing could therefore be complete sooner than mid-2022, which was the original target. In response to a question, he said - “It is appropriate, I think, for us to discuss at our next meeting, which is in a couple of weeks, whether it will be appropriate to wrap up our purchases a few months earlier”, saying also that in the next fortnight a lot more would be known about Omicron.

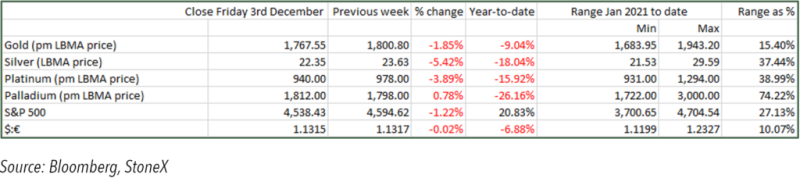

The markets all reacted swiftly, but – as usual – gold was among the more robust (see chart below), shedding just 2.6% and then recovering. Silver initially fell by only 2.7% - but as the week wore on gold picked up while silver prices slid a lot further. The S&P and oil were hit hard, as the markets responded to fresh concerns over damage to the economic recovery, with the equities index dropping by 3% and then stabilising, while crude oil fell by 6%, but then unwound roughly half of those losses.

The past week neatly encapsulates the key difference between gold and silver. Silver is often referred to as a safe haven, but we do not subscribe to this view. It is perhaps understandable that some observers think of silver as a safe haven because of its relationship with gold, but this is not the case. To start with, it is much more volatile than gold (we often talk about how silver will outperform gold in a bullish environment and under perform in bearish conditions). Next; gold acts as a non-fiat currency while silver does not have any role as a currency anymore. And thirdly, roughly 60% of silver demand is for industrial purposes rather than decoration or silverware. As a result, when there are economic fears in the markets silver will often look to its industrial base and this is what happened last week. Our most recent supply-demand estimates point to a silver global silver market in a broad balance this year and a small deficit next year.

Remember that silver does not have a viable market-clearing production cost because primary silver mines account for only 25% or so of total supply, with the rest coming as by-product of lead-zinc, gold or copper mines along with industrial scrap. None of these elements, therefore, are price-elastic except scrap supplies in times of extreme prices.

The economic outlook does of course remain unclear as we wait to see the impact of the Omicron virus variant, and this has put something of a cloud over silver market sentiment. On the other hand, economic and geopolitical risks are still favourable for gold. On this basis, while gold remains neutral silver may well continue to underperform, but when gold picks up again (which may well be some time as the markets wait for the result of the next FOMC meeting on 15th December) silver should catch up.

Gold silver, oil, equities and the dollar; six months’ view

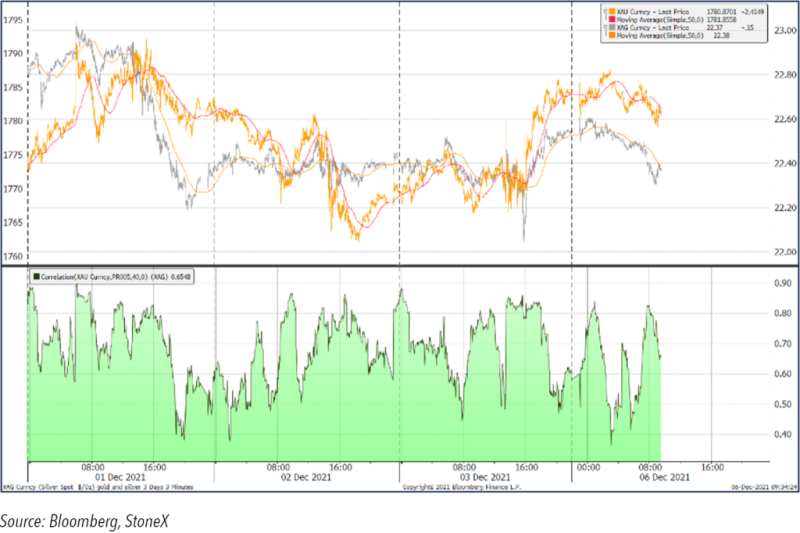

Gold, silver and their correlation