Aug 2018

Aug 2018

Reasons for slumping gold price

By StoneX Bullion

Strengthen of US dollar

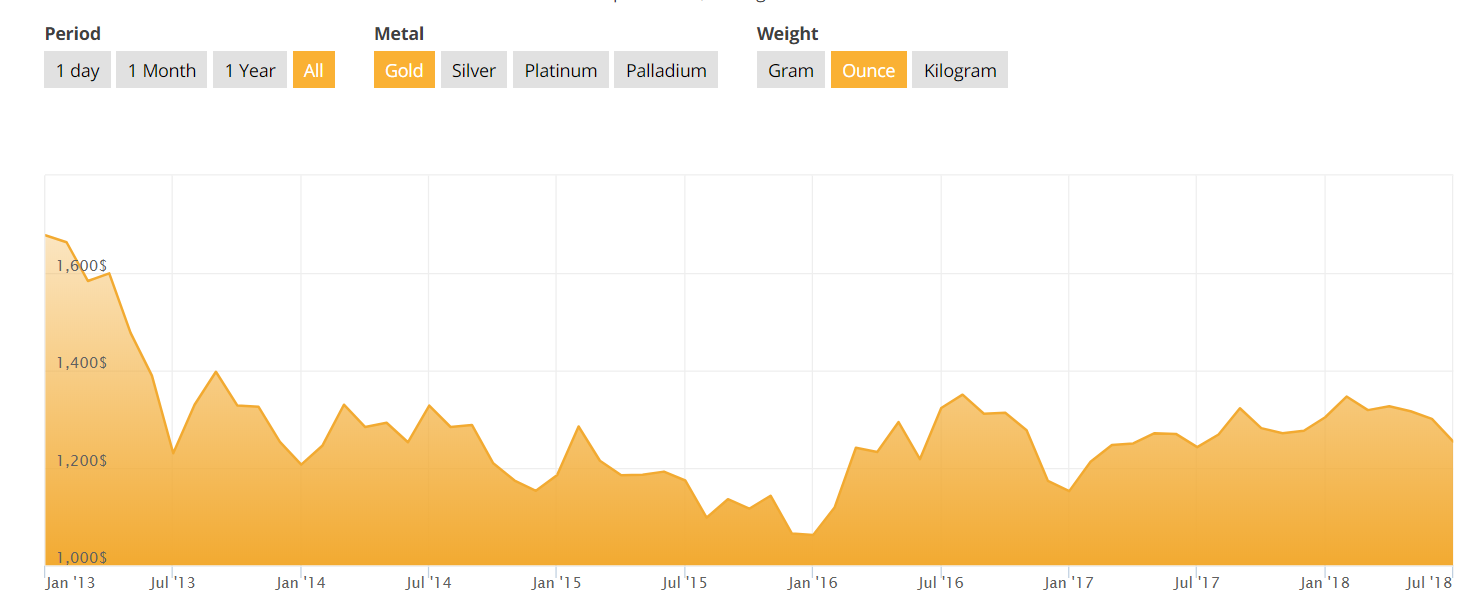

Normally measured in US dollar, gold price is directly linked to the US dollar. Historical data shows a reverse trend of the movement between gold price and dollar.

Interest rate and expectation on inflation

One of the short term drivers is interest rate. Since gold doesn’t generate any interests, when interest rate increases, the cost of holding gold is higher. The US Fed Fund rate is also observed to be rising. Whether to invest in gold or securities depends partly on people’s expectations for inflation. A higher expectation on inflation would drive investors to invest in gold. Besides, inflation is closely related to interest rate. A rising interest rate may indicate a lower expectation of inflation, thus the demand of gold decreases.

A glance at the fundamentals

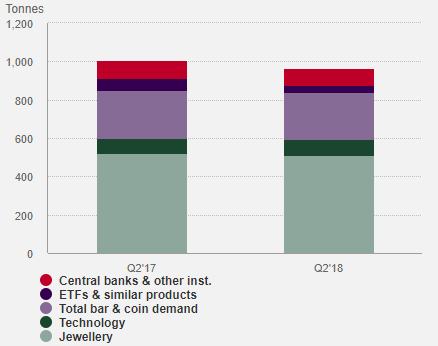

From the perspectives of gold demand and supply, gold supply saw an increase up to 3% in Q2; gold demand was also 4% weaker mainly due to slower ETF inflows.

Source: Metals Focus; World Gold Council

Summary

Gold price fluctuates around fundamentals as it used to be in history. But since the measurement of price, the US dollar moves reversely, there might be a relatively stable value. And because of the low correlation with other financial markets, investing in gold and other precious metals serves as a good role for the diversification of portfolios. Furthermore, gold is worth owning when there is a potential market stress. Gold price may bound back once the US market starts calming down after the booming at the beginning of the trade war. Or since there are little allies in the war, how much would gold price be linked to the US dollar is determined by how long will the US be the benchmark.

Reference

Forbes.com. (2018). [online] Available at: https://www.forbes.com/sites/simonconstable/2018/06/18/5-reasons-the-drop-in-gold-prices-shouldnt-worry-investors/#7af0fb1b8098 [Accessed 3 Aug. 2018]. Tradingeconomics.com. (2018). United States Fed Funds Rate | 1971-2018 | Data | Chart | Calendar. [online] Available at: https://tradingeconomics.com/united-states/interest-rate [Accessed 3 Aug. 2018]. 2018, G. (2018). Gold Demand Trends Q2 2018 | World Gold Council. [online] Gold.org. Available at: https://www.gold.org/research/gold-demand-trends/gold-demand-trends-q2-2018 [Accessed 3 Aug. 2018]. 2018, G. (2018). Gold Outlook | Gold Outlook Mid-Year 2018 | World Gold Council. [online] Gold.org. Available at: https://www.gold.org/research/gold-outlook-2018-mid-year [Accessed 3 Aug. 2018]. Investopedia. (2018). How does inflation affect the exchange rate between two nations?. [online] Available at: https://www.investopedia.com/ask/answers/022415/how-does-inflation-affect-exchange-rate-between-two-nations.asp [Accessed 3 Aug. 2018].