Mar 2023

Mar 2023

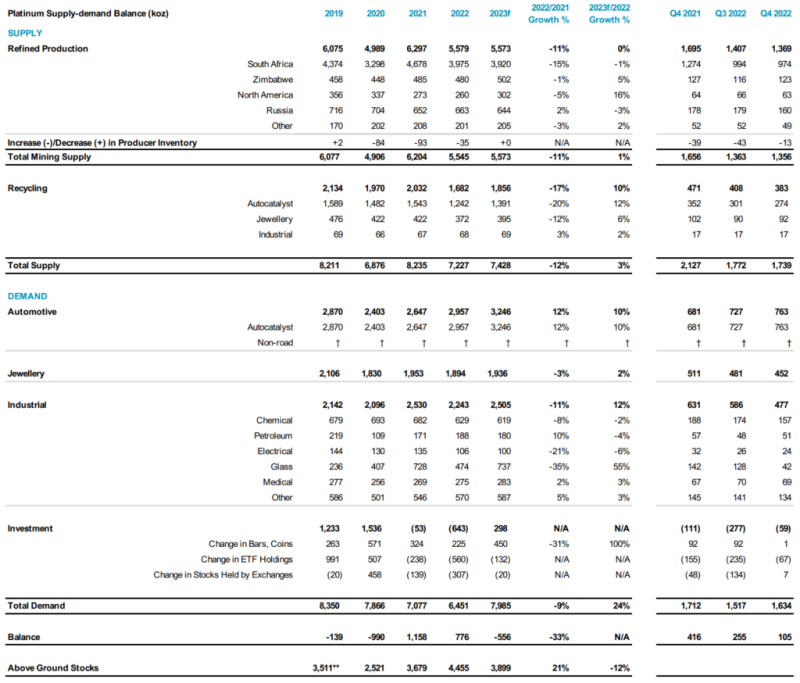

Platinum deficit of 556 koz forecast in 2023, as strong demand growth outstrips constrained supply

By StoneX Bullion

Press release: World Platinum Investment Council — London, 00.01 8 March 2023

- Platinum deficit forecast for 2023 as demand to grow by 24%, while supply by just 3% due to severe constraints

- Automotive demand set to rise 10% in 2023 on increased platinum for palladium substitution and higher loadings

- Industrial demand in 2023 to increase 12% year-on-year, almost matching its strongest year on record

- Investment demand in 2023 forecast to improve by over 900 koz on strong bar and coin demand and much lower ETF and exchange stock outflows

The World Platinum Investment Council - WPIC® - today publishes its Platinum Quarterly for the fourth quarter of 2022, full year 2022, and a revised forecast for 2023.

After two years of significant surpluses the platinum market is forecast to move to a material deficit in 2023. The change from the 776 koz surplus in 2022 to the forecast deficit of 556 koz in 2023 is over 1.3 Moz. This reflects total supply remaining close to the weak level in 2022, up only 3% to 7,428 koz (+201 koz), and strong demand growth of 24% to 7,985 koz (+1,534 koz).

Supply down 12% in 2022, and expected to remain weakened

Total supply was down in both Q4’22 (-18% year-on-year to 1,739 koz) and full year 2022 (-12% to 7,227 koz), as prevailing headwinds in both mining and recycling supply severely curtailed output.

For 2022, total mining supply declined 11% year-on-year (-659 koz) and is forecast to remain broadly flat in 2023 (+28 koz). Refined mine production in 2022 also declined 11% year-onyear (-718 koz) almost entirely due to lower output from South Africa. Output here declined 24% (-300 koz) year-on-year in Q4’22 as a result of smelter maintenance, operational challenges, and the impact of the country’s well-documented electricity supply issues. Meanwhile, Russian production in Q4’22 declined 10% (-18 koz) year-on-year due to logistical challenges impacting the flow of material between Russian and Finnish processing facilities.

Global recycling in 2022 fell 17% year-on-year (-349 koz) on reduced availability of end-of-life vehicles and lower jewellery recycling. Autocatalyst recycling declined as a result of new vehicles’ low availability meaning cars are being driven for longer. This was compounded by changes in consumer behaviour as a result of cost-of-living concerns and lower mileage due to remote working. Jewellery recycling was down, primarily due to slower jewellery sales in China impacting sell-backs. Global recycling is expected to recover by 10% in 2023 to 1,856 koz, driven by an increase in the availability of spent autocatalysts, with autocatalyst recycling forecast to recover by 12% to 1,391 koz.

Automotive demand growth trajectory continues into 2023

The global automotive market remained on an improving path during much of last year, showing resilience despite the lingering chip shortage, cost-of-living concerns, the impact of the Russia-Ukraine war, and the severe lockdown in China. Automotive demand for full year 2022 increased by 12% year-on-year (+311 koz), reaching 2,957 koz.

Despite vehicle production remaining short of pre-pandemic levels, a combination of factors are boosting platinum automotive demand growth. Firstly, in 2022, there was a 28% increase in the manufacture of hybrid vehicles, which typically require higher loadings in the aftertreatment system. Secondly, tighter emissions legislation, particularly in China, also resulted in higher loadings (especially in heavy-duty diesel vehicles). Lastly, there was growing platinum for palladium substitution, and, significantly, the increase has meant an upward revision to the substitution estimate by close to 100 koz, to 540 koz for 2023.

With these trends set to continue, global automotive demand is expected to increase by 10% in 2023 to 3,246 koz (+288 koz).

Industrial demand in 2023 forecast to match the strongest on record

Industrial demand for platinum is expected to be an area of stand-out strength in 2023, up 12% year-on-year to 2,505 koz (+262 koz), and just 26 koz below the level in 2021, the strongest year on record.

This strong demand growth will be driven by the construction of new LCD capacity

installations in Japan and from China’s project pipeline as the country’s COVID-19 restrictions

ease. Within the glass industry, platinum demand will increase by 55% to 737 koz, offsetting

modest declines forecast in the chemical (-2%), petroleum (-4%) and electronics (-6%)

sectors.

Jewellery demand set to increase as restrictions in China ease

With China, the largest platinum jewellery market, in lockdown for much of 2022, jewellery demand declined by 3% (-59 koz) to 1,894 koz for full year 2022.

As restrictions ease, and consumer confidence returns, 2023 is forecast to see a 15% (+73 koz) demand increase in China. Growth is also expected in Japan and in India. Meanwhile, declines are anticipated in Europe and North America on account of fewer weddings and recessionary fears. In all, global jewellery demand is expected to improve by 2% (+42 koz), growing to 1,936 koz in 2023.

Investment demand recovery forecast in 2023 – improving by over 900 koz

Investment demand is expected to improve significantly in 2023. Platinum bar and coin demand is forecast to jump by 100% to 450 koz in 2023, a three-year high, reflecting improved product availability in North America and Europe and net disinvestment in Japan swinging to net investment. Meanwhile, outflows in ETFs (-132 koz) and exchange stocks (-20 koz) will continue to slow, with some renewed interest in South Africa for platinum ETFs in preference to mining equities. The result will mean net investment demand of 298 koz in 2023.

Trevor Raymond, CEO of the World Platinum Investment Council, commented: “From a macro perspective, 2023 is expected to be a difficult year, with an uncertain economic environment, inflationary headwinds, and a global energy crisis. And yet, going against the grain, the platinum market is forecast to be in deficit after two consecutive years of significant surpluses. This year’s forecast deficit is unlikely to be a one-off, either, with challenges to supply expected to continue and future demand growth, supported by the needs of the hydrogen economy, likely to result in deficits continuing for a number of years.

“Although power supply risks and operational challenges are included in forecast mining supply for 2023, a worsening of electricity supply shortages in major producer South Africa or sanctions-related operating challenges in Russia present downside risks to supply. In contrast, although demand forecasts include the negative impact of inflation and lower global economic growth, their downside is well protected. Here, strong demand growth results mainly from ongoing platinum for palladium substitution in automotive applications, already committed glass capacity additions, robust bar and coin demand, and the significant outflows from ETFs and exchange stocks having largely run their course.

“Since 2021, we have observed the massive platinum imports into China – which were far in excess of identified demand – much of which have not been captured by our published data. Whether this will reflect actual demand – as we are seeing with the glass capacity expansions in 2023 identified in today’s report – or stock held in China, it may not be available to re-enter Western markets to address the deficit in 2023 due to domestic export controls, and so will lead to further market tightening.

“Looking beyond today’s report we continue to highlight the strong link between platinum and the hydrogen economy. While hydrogen-related platinum demand is relatively small, it is expected to grow substantially in the medium term; as hydrogen demand becomes meaningful platinum could become a proxy for investors looking for exposure to hydrogen. An emergent new end source of demand for a commodity is a relatively rare occurrence and somewhat unique to platinum at this point in time, which only strengthens the investment case for platinum, particularly in a deficit market”.

Disclaimer

Neither the World Platinum Investment Council nor Metals Focus nor StoneX Bullion is authorised by any regulatory authority to give investment advice. Nothing within this document is intended or should be construed as investment advice or offering to sell or advising to buy any securities or financial instruments and appropriate professional advice should always be sought before making any investment. For further information, please visit www.platinuminvestment.com.