Feb 2021

Feb 2021

The Importance of Platinum

By StoneX Bullion

Most of our blog posts and products sold at https://stonexbullion.com focus on silver and gold. In this blog post, however, we want to dig a little deeper into another precious metal, platinum. To help us, we spoke to Trevor Raymond, Director of Research at the World Platinum Investment Council.

What has caused the recent interest in platinum and the rise in its price?

Mined supply of platinum is constrained after a decade of weak prices and underinvestment in mine capacity, with any material growth in supply at least three years away. Significant demand growth is expected in the short to medium term as platinum substitutes for palladium in automotive catalysts, and in the medium to long term as platinum is used to generate green hydrogen and in fuel cell electric vehicles. Investors recognise that platinum is significantly undervalued compared to its precious metal peer, gold, and its one-to-one substitute industrial metal, palladium.

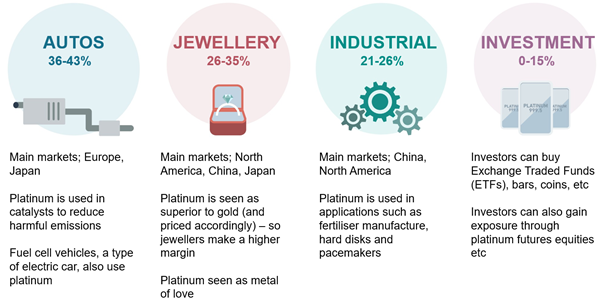

What is platinum used for?

Platinum is both a precious metal and an industrial metal – over 65% of platinum consumption is expected to come from automotive and other industrial uses this year.

From an investment perspective, the platinum price is closely correlated to the gold price, bringing similar diversification benefits to a portfolio, as well as being a hedge against currency and interest rate fluctuations and a store of value. Platinum is also a hard asset, which, like gold and other commodities, has been in great demand amidst the extreme volatility of many equities recently.

Platinum has a unique combination of physical and chemical properties which is why it is used extensively in industry and manufacturing, where its high melting point, density, ultra-stability, extreme non-corrosiveness, and catalytic effects are highly valued. In fact, one of platinum’s most important uses is as a catalyst – the presence of even a small molecule can speed up chemical reactions, reducing process energy needs and improving yields. Biocompatible and well tolerated by the body, platinum is also used in numerous established medical treatments and is at the forefront of many new ones.

What is more, platinum is at the forefront of two key technologies that are unlocking the rapidly expanding, zero-emissions hydrogen economy – fuel cells and electrolysers. At the same time, it remains key to the automotive industry, reducing emissions from internal combustion engine vehicles. Indeed, platinum is currently growing its share of the autocatalyst market as it continues to substitute for significantly more expensive palladium in gasoline engine vehicles on a one-to-one basis. Additional annual demand of 1.5 moz per annum is expected as a result of substitution in 2025, a material addition to the current total annual demand of around 8 moz.

Investors, familiar with platinum’s strong correlation to gold, are becoming more aware of the significance of platinum’s industrial credentials, which are providing upside as the global economy recovers from the effects of the COVID-19 pandemic. Coupled with its strong demand growth potential from the automotive and hydrogen sectors, more and more investors are viewing platinum’s current discount to its peers – both precious and industrial – as an investment opportunity.

What does the hydrogen economy mean for platinum?

Momentum behind the hydrogen economy, and in particular technologies related to green hydrogen made from renewable electricity, is undoubtedly growing. It is now estimated that green hydrogen could supply up to 25% of the world’s energy needs and become a US$10 trillion addressable market by 2050.

Platinum’s dual role - in electrolysers to make green hydrogen and fuel cells - makes it a major beneficiary as the hydrogen economy takes off; the global platinum demand impact of announced green hydrogen policies is clearly sizeable over the longer-term. Current EU and China green hydrogen generation capacity targets alone would require, cumulatively, over 300 koz of platinum by 2030. Even more significantly, as the hydrogen economy grows it will facilitate the adoption of fuel cell electric vehicles (FCEVs). FCEV market growth has the potential to create strong demand for platinum, providing a robust basis for platinum as a long-term store of value, with platinum use in FCEVs expected to exceed an additional 1.5 moz per annum in 2030.

What influences the price of platinum?

The outlook for an investment in platinum is, as with all commodities, intrinsically linked to its fundamental supply/demand position, with value tending to reflect the market balance. Typically, prices rise on consecutive deficits and fall on consecutive surpluses, although this is not always the case. The platinum market remains tight, with platinum forecast to record its third consecutive deficit in 2021.

Overlaying this dynamic is the relationship between platinum and other platinum group metals (PGMs), especially palladium. PGMs are interlinked with regard to supply as well as demand, being co-products or by-products in the majority of their mining locations, recovered together as well as being recycled from many end-of-use products and substitutes for each other in several applications.

Platinum mine supply is unusually highly concentrated, with over 70% of global mine supply coming from a relatively small geographic region in South Africa. Here supply has declined from a peak of 5.3 moz in 2006 to 4.4 moz in 2019, due largely to declining margins and limited capital investment.

When compared to gold and silver mine supply, platinum supply reflects its scarcity as a resource. In 2019, the mined production of silver, gold and platinum was 836 moz, 113 moz and 6m oz, respectively. Each year, a further 2 moz of platinum comes from mainly autocatalyst and jewellery recycling.

While supply remains constrained, investors are seeing strengthening industrial demand growth potential. Tightening emissions control standards in the automotive sector are a key driver, with the introduction of new European fleet CO2 emissions targets last year and the implementation of China 6 (light duty) and China VI (heavy duty) emissions regulations resulting in higher palladium and platinum loadings on emissions control systems in mainly gasoline cars and diesel trucks. What is more, the high price of both palladium and rhodium, coupled with constrained supply, is seeing a growing substitution of platinum for palladium in gasoline autocatalysts.

The importance of platinum to the expanding hydrogen economy is also increasingly on investors’ radar.

Why invest in platinum?

Gold is widely recognised as the asset least correlated to other asset classes. In times of increased global risk more investors turn to gold as a risk hedge and as a store of value ─ its longstanding primary role. Platinum is seen by many gold investors as an industrial metal, vulnerable to economic downturns. However, increasingly, investors are recognising platinum’s precious attributes alongside its industrial characteristics ‘a best of both worlds’ offering that is shining a spotlight on its upside potential as the global economy stages its post-pandemic recovery.

It is interesting to note that during the market turbulence of 2020 when investors sought safe-haven assets and platinum and gold saw price lows on 19 March 2020 of $599/oz and $1,474/oz respectively, platinum went on to significantly outperform gold, rising 80% versus gold’s rise of 26%, by the end of January 2021.

Platinum’s price outperformance, when compared to gold, was no anomaly. In the two years subsequent to the price lows of the Global Financial Crisis (GFC) in late 2008, platinum's weekly returns outperformed those of gold by between 30% and 65%.

After the GFC, platinum’s price performance was not solely due to growing investment demand; it was sustained by its growing industrial demand and exceptionally strong platinum jewellery demand, which, coupled with limited supply growth, maintained positive investor sentiment despite very weak automotive demand.

There are parallels with today. Platinum market fundamentals continue to improve appreciably, not only with strong investment demand but also due to growing recognition of strong industrial demand drivers - platinum substitution for palladium in autocatalysts and hydrogen and fuel cell prospects, as well as ongoing constrained supply.

What is the primary mission of WPIC?

The World Platinum Investment Council (WPIC) is a global market authority on physical platinum investment, formed to meet the growing investor demand for objective and reliable platinum market intelligence.

WPIC’s mission is to stimulate global investor demand for physical platinum through both actionable insights and targeted product development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

WPIC was created in 2014 by the leading platinum producers in South Africa. WPIC’s members are: Anglo American Platinum, Impala Platinum, Northam Platinum, Royal Bafokeng Platinum and Sedibelo Platinum.

If you have any further questions about investing in platinum, feel free to reach out to our fantastic team at customercare@stonexbullion.com, who will be more than happy to help you out!