Apr 2022

Apr 2022

Gold trying to break higher – markets firmly in risk-off

By StoneX Bullion

It’s always a sign of extreme nervousness when the dollar, Treasury yields, and gold are all moving higher. With the markets now fully expecting a 50-point rate hike from the Federal Open Market Committee at its meeting of 3rd and 4th May, attention has been increasingly focused on geopolitical risk, which of course revolves largely around Ukraine. The other recent area of some contention has been in the oil sector and while OPEC+ appears to be working harmoniously, the producers have, between them, missed their increased production targets for the past four months, and by an increasing margin each time.

At the physical end of the gold market activity is very sluggish and it is perhaps surprising that, as the gold price nudges higher, there has not been any return of pre-emptive buying yet. Equally, though, there is no sign of any selling into this moderate strength. The renewed lockdowns in China are of course seriously impeding any interest in that part of the world and so, as and when conditions return towards normal, we can expect to see the unleashing of pent-up demand from the mainland.

In terms of actual price action gold has moved out of its four-week trading range of $1,890 to $1,930 and as we write is trading up towards $1,960, which is precisely on the Fibonacci 38.2% retracement from the March slide from $2,070 to $1,892. The technical picture in terms of the moving averages is also strengthening, with the 10-day moving average crossing the 20-day to the upside.

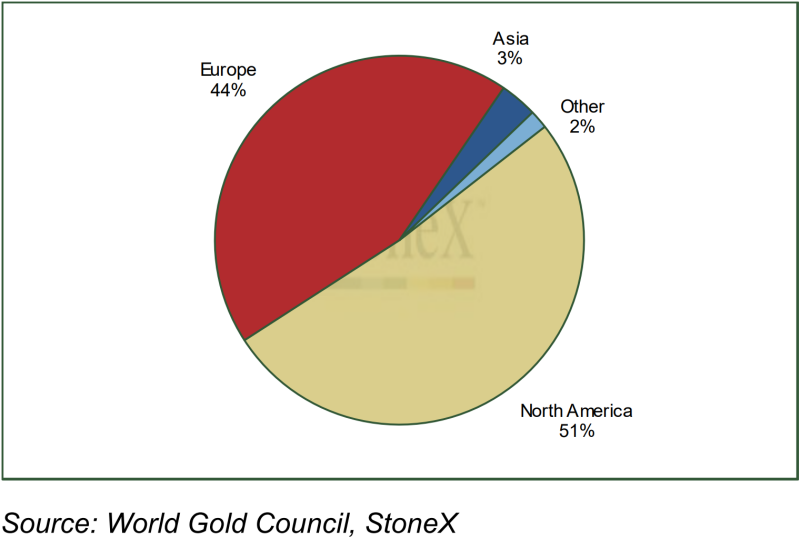

While the physical market is quiet at the grass roots level, professional investment is still relatively active. The gold ETFs have added 277t so far this year and now stand at 3,848t, which is roughly 200t more than global production in 2021 (as estimated by Metals Focus). The rate of absorption in the first quarter of the year is equivalent to roughly 29% of world gold mine production over the year. Since the invasion (25 trading days) the funds have taken in 192t, which on an annualised basis would be equivalent to just over 2,000t. The highest tonnage increase through to the end of March was in North America, but that makes sense because North American funds at end-March held 51% of total, with Europe at 44%. Asia 3% and 2% for other regions. In percentage terms, the gains in North American funds were 5.37% and in Europe, 5.46%. Asia added 2.2% and the rest of the world, 2.6% (numbers generated from the World Gold Council monthly sheet of daily changes).

One final note – some press commentators are saying that Russia has pegged the rouble to gold. This is incorrect. The announcement last week revolved around what the Central Bank of Russia will pay domestic banks for gold; setting a benchmark of 5,000 roubles per gramme. At today’s rates that is equivalent to $61.50/g or $1,913/ounce, a discount to loco London spot of 2%. This is a reversal of the policy that was implemented on 15th March when the bank suspended purchases from domestic banks to allow them to meet very strong local demand for physical gold bars, especially after the abolition of VAT on them. The Bank is projected to have said that this price will remain fixed until 30th June. So this is a domestic transaction price, not a gold standard.

Spot Gold, short term

Regional distribution of gold ETP holdings, end-March 2022