Nov 2021

Nov 2021

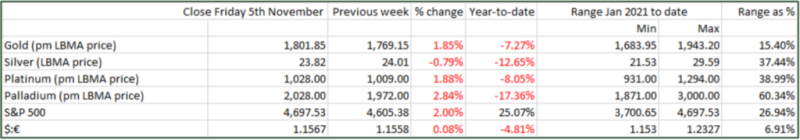

Gold and silver; one headwind out of the way?

By StoneX Bullion

The smart upward moves in gold and silver at the end of last week have carried on into the start of this week, with gold actually moving away from its ten-day moving average. From mid-August into early November the ten-day average had been very close to gold as the metal’s price oscillated around a very shallow declining trend. While the sharpness of the move in two trading sessions makes it feel as if the metal has broken out, it hasn’t quite done so. What it has done is move into overbought territory as it approaches two-month highs at $1,825, with the ten-day average now offering support at $1,797.

Silver, meanwhile, has followed suit; its own recent downtrend line has been steeper than that of gold (btu still pretty shallow overall) with the ratio duly widening – at least until end-September. We wrote a few weeks ago about how, when gold is directionless, the ratio between gold and silver often widens. Also, when a change in trend is imminent, it is not at all unusual for silver to turn first. This time the impulses in the two metals’ markets have generally coincided with one another and as gold approaches two-month highs, silver is doing the same, at $24.40 – apart from a brief flare-up in late October when it whipped up to $24.83, only to fall away again in what looked like a false start. Silver’s higher volatility, though, has meant that the ratio has been closing and, at 73, is now almost 10% below the recent peak of 80 at end-September when gold was $1,756 and silver was $20.17. Silver, also, is towards the top of its recent trading range but it, too, is overbought and both metals may need a period of consolidation.

Friday was an interesting day from the point of view of the interplay between economic news and the financial markets. The nonfarm payroll figures, released last Friday, were generally ahead of expectations and should, in theory, therefore, have served to strengthen the dollar and boost bond yields. In fact the reverse happened, and gold and silver started their moves higher (aided by the fact that the 20-day moving average crossed the 50-day to the upside two days earlier, the day that the FOMC Statement was released). This looks as if we have just gone through a classic “buy the rumour, sell the fact” exercise, although this time it was in reverse, as “sell the rumour, buy the fact”. The “fact” in this case, is in our view the outcome of the Federal Reserve Open Committee’s (FOMC) meeting last week, in which the FOMC outlined the plans for its tapering exercise and confirmed that

it should start in late November. It also made the point that any interest rate changes would be later – a stance to which it has held consistently.

For months now the markets have keenly watched the FOMC and whole tapering has been increasingly widely expected since the summer months. Even so, every time the FOMC has pronounced through the year, there have been knee-jerk reactions in the markets, and almost always downwards, for gold on the expectation of tightening financial conditions and rising rates with the Fed no longer standing in the Treasury markets, (at least not to such a great extent). This time, with the actual announcement of the programme, there was no such reaction, and we can therefore probably say with some certainty that those particular headwinds are now safely overcome – provided nothing untoward happens, of course.

So it is arguable that the continued talk of inflationary forces and the possibility that “transitory” may have to make way for “persistent” although the jury is still out on that one, but most central banks are dovish, which is also supportive for gold) was reinforced by stronger nonfarm numbers than were expected. We continue to argue that gold’s relationship with inflation only becomes significant when inflation itself is an economic threat rather than a boon; more important is the impact of inflation on real yields. Given that real yields in the industrialised world are negative and likely to remain so, gold remains supported by tailwinds and one headwind, in terms of sentiment at least, is now out of the way.

Gold and silver may still have some work to do before they move into a newer higher range. The prospects are improving, however, with weak-handed holders coming out of COMEX gold and silver long positions, although silver’s failure in late October to break above $25 did see some fresh shorts go into place. We suspect that part of the recent move will have generated short covering. The physical markets are coming to life again, but they are not of themselves enough to take prices higher; for that we need the professional constituency to be on board.

Gold, silver and their respective relative strength indices; both overbought in the short term

Source: Bloomberg, StoneX

Gold and the inverse of the dollar; the correlation is weakening

Source: Bloomberg, StoneX

Source: Bloomberg, StoneX