Mar 2022

Mar 2022

Gold — A short-lived recovery after the speculative clear-out — US potentially freezing Russia’s gold reserves

By StoneX Bullion

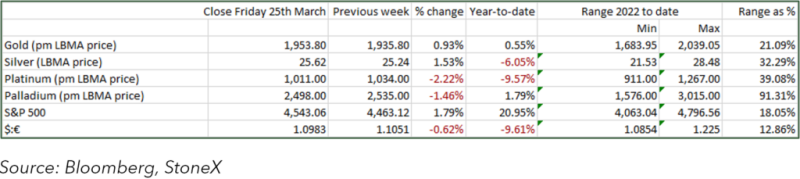

With the Fed March meeting now out of the way, geopolitics has been the primary focus of the markets over the past week – although the increased hawkishness from Chair Jay Powell and other members of the Federal Open Market Committee (FOMC) at the start of last week, only a couple of days after the FOMC meeting, did put some further pressure on gold prices at the outset. Over the week as a whole prices traded up, in thin conditions, to test $1,970 on Thursday, stabilised on Friday but have now come down $30 with a thud at the start of this week; as we write spot is trading at $1,930, more or less unchanged from this time a week ago.

Conditions overall have been relatively sluggish, and this has contributed to the comparative volatility in intra-day prices; this morning’s dip looks as if it was triggered by profit taking.

Investor sentiment has remained positive in the face of continued geopolitical risk, as evidenced by the continued rise in Exchange Traded Products. Since the date of the invasion we have had 22 trading days, of which 20 have been days of investment and just two have seen redemptions. Since 24th February ETP holdings have increased by 175t for a net dollar inflow of $10.7Bn. The current value of the global gold ETP holdings, at almost 3,300t and at $1,930/ounce, is $204Bn, roughly equivalent to Peru’s GDP.

On the other side of the market the managed money gold positions since the start of the invasion have changed as follows (from 22nd February): outright long positions on COMEX down by 95.7t from 570.3t to 474.6t and outright short positions down by 21.5t from 138.0t to 116.5t. This leaves the net long position at 358t, compared with an average of 249t over the previous twelve months.

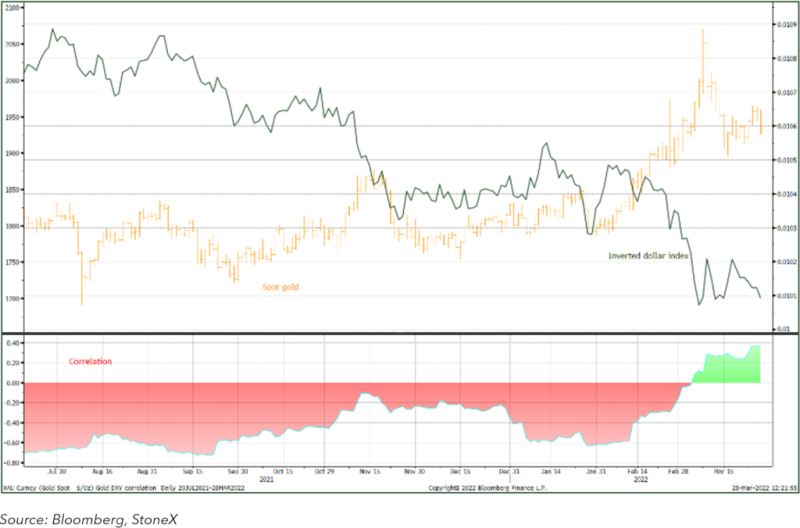

The dollar has generally been the primary safe haven in recent weeks, but interest in gold, while perhaps somewhat subdued, is still relatively solid. That said, the technical construction on the charts is against it, with the 10-day moving average below the 20-day, and spot currently below both.

Meanwhile a bilateral team of Senators is pursuing discussion with Treasury Secretary Janet Yellen over their desire to freeze Russia’s gold reserves. President Biden has signed an executive order prohibiting gold transactions with sanctioned Russian entities, including the Central Bank, the National Wealth Fund of the Russian Federation and the Ministry of Finance. While in theory Russian gold could be sold, for example, via the Shanghai Gold Exchange, the move from the Congressmen may deter potential counterparties from engaging in gold-related trades with Russia. We noted in a commentary on 9th March here that Russian gold reserves vastly exceed the value of Russia’s foreign sovereign bonds, but the volume that would be involved, even just to cover those liabilities, would be far too large for the market to absorb – and certainly not without inflicting damage on the price and now, quite apart from the prohibitive logistics, the political arena works against the idea. The LBMA and the Chicago Mercantile Exchange (which owns COMEX) have already suspended Russia’s gold and silver refineries from the Good Delivery Lists. Domestic sales are a possibility, but in practice the CBR is believed to be buying domestically mined gold and gold from domestic banks.

Gold and the U.S. dollar

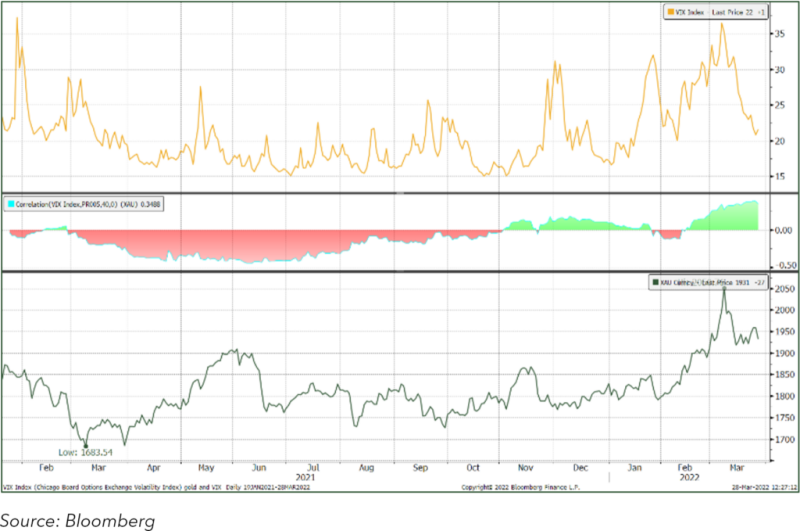

Gold, and the VIX uncertainty index