Mar 2022

Mar 2022

Gold – reached to within a whisker of the record

By StoneX Bullion

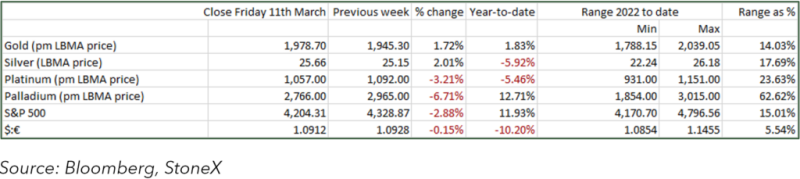

The invasion of Ukraine had been expected by many in the markets and this would tend to suggest that those who intended to use gold as a risk-hedge might well have been positioned days or weeks before the invasion itself, which was 24th February. Gold clearly did rally on the day of the invasion, although the move didn’t last long and gold closed lower than it opened. Interestingly, gold and Brent crude moved almost in lockstep on the day, reflecting safe haven and economic concerns respectively. Subsequently we saw gold reach a high LBMA Auction price of $2,039.05 on 8th March, but over the period gold has been on something of a roller-coaster as speculators have come in and retreated again.

Gold and Brent one-minute moves on the day of the invasion

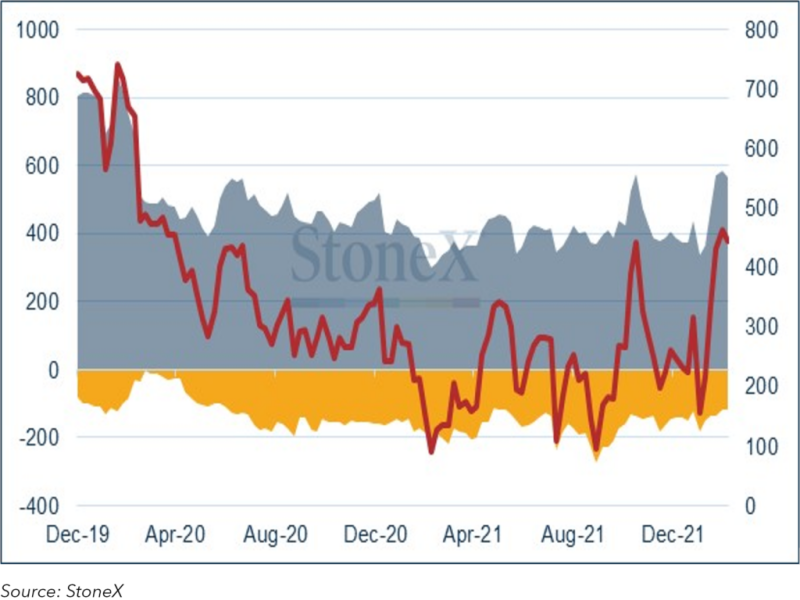

The CFTC numbers show us how sentiment among money managers on COMEX has developed; in the week to Tuesday 1st March, the net long gold position gained 30t to 462t, comprising an increase of 12t in outright longs and 18t of short covering. In the following week there was some profit taking, but the subsequent rise in the price, to reach an intraday high of $2.070 on 8th March, suggests activity in the OTC market.

Positioning of Money Managers’ gold contracts on COMEX

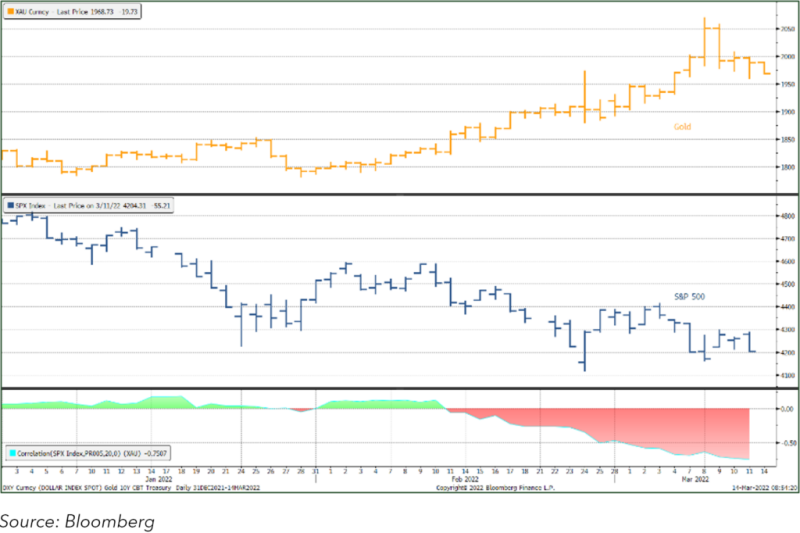

Meanwhile the correlation between the major U.S. equities and gold reverted to negative territory, reaching as low as minus 0.74 at the start of this week as the S&P tries to regain a firm footing and gold is also looking to consolidate.

Gold, the S&P 500 and their correlation

Meanwhile the physical markets have dried up in south and east Asia in response to the rise in price and there has been a fair amount of selling back, so it is highly likely that the refineries will be busy with scrap material in the near future. Retail demand for coins in the west, as proxied by the U.S. Mint’s sales of Gold and Silver Eagles, show relatively sluggish demand in February, with Gold and Silver Eagle February sales down by 31% and 53% respectively against February 2021, but March gold coin sales have picked up smartly. The Perth Mint has also reported sales of 72,651 ounces of gold and 12.6M ounces of silver in minted product form in February. This was a month-on-month gain of 89% for gold but a 32% decline in silver; and against year-ago levels they were down by 41% and 11% respectively.

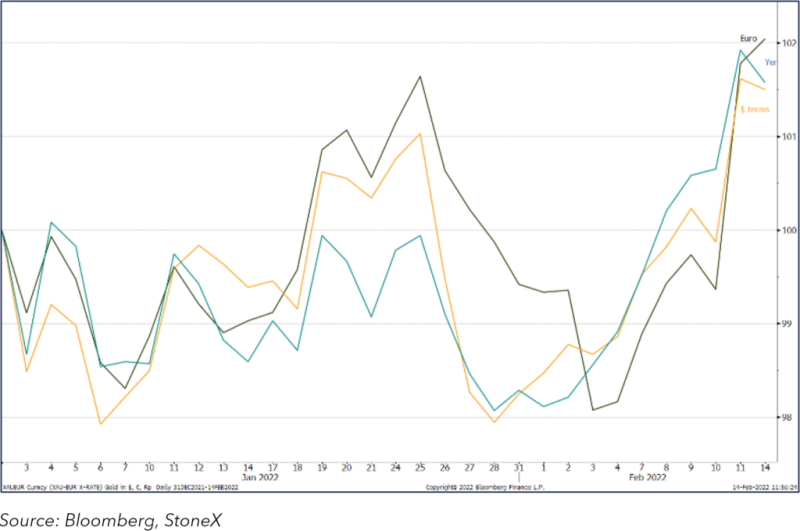

Gold in dollar, euro and rupee terms; independent strength

As we write, gold and silver prices have come off their recent highs and are looking to stabilise. Persistent geopolitical fears and uncertainties are likely to keep prices reasonably buoyant, especially now that some of the speculative froth has been taken off the market., As noted above, we suspect that risk-hedgers were already in the market before the invasion, while some speculative buyers are likely to have locked in some profits, and others may be in the camp of stale-bull liquidation on the basis that the pumice did not rise further than it did.