Mar 2022

Mar 2022

Gold – off the highs in a speculative retreat

By StoneX Bullion

When we wrote at the start of last week gold was trading in the region of $1,975, having come off the approach to record levels in the previous week. Prices continued to fall into midweek, briefly testing $1,900 before finding some tentative support and since then it has been looking to consolidate between $1,920 and $1,950. From 8th-16th March the fall was 8.5%; this is the largest percentage short-term drop since the fall in March 2020, when gold came off the record high of $2,070 as yields rose and Russia developed a virus vaccine (plus it had been heavily over bought). Early in this past week there was some hope of an improvement in the situation in Ukraine, which put some pressure on gold, while the market was also awaiting the outcome of the March meeting of the Federal Open Market Committee (FOMC), the policy decision-making body of the Federal Reserve, which took place on Tuesday and Wednesday.

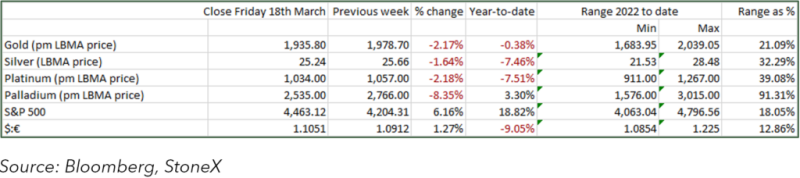

In the event the hopes for Ukraine turned out to be misplaced (or perhaps premature would be a more optimistic word), while the outcome of the Fed’s meeting and the associated policy pronouncements were much as expected – although it was noticeable that yields rallied relatively hard in advance of the Statement. In short, the Fed hiked the fed funds target rate by 25 basis points. Previously there had been some thoughts in parts of the market that the hike would be 50 points, but the onset of the Ukraine war dispelled those thoughts in favour of prudence on the part of the FOMC. The Committee noted that there would likely be a further six 25-point hikes over the course of this year, and the consensus expectation from the Committee is that the median level of the rate will be 1.9% by the end of this year.

Gold and the U.S. two-year bond yield

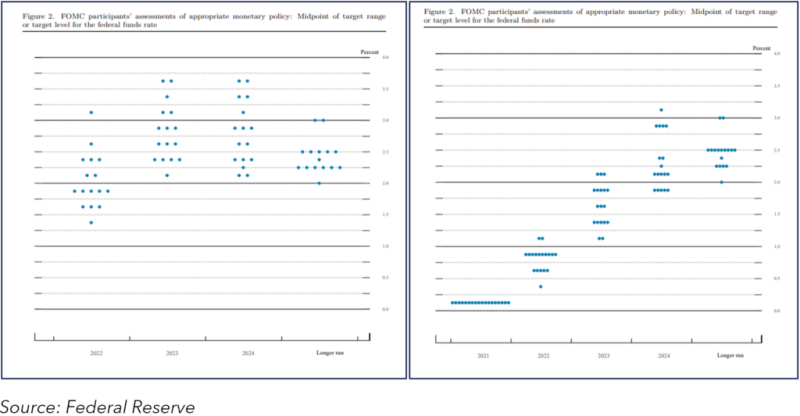

The Fed Dot Plots; March (left) and December (right)

Each dot represents the opinion of a committee member as to where the mid-point of the fed funds target rate will be at the end of the year. Note that there are no expectations for any increases in 2024 and that rates are expected to come down in the longer run.

As far as gold and silver are concerned, although the watchword from the Fed this time was “uncertainty”, we can certainly argue that the “neutral” approach with respect to 2024 gives the markets some sense of clarity, at least in terms of how the Fed is looking at the medium term and thus is helping the consolidation. As far as investor activity is concerned, the Gold Exchange Traded Products have added gold on 15 days of the 17days since the invasion. That amounts to 132t of gold for a net dollar inflow of $8.3Bn. To put this into context, global gold mine production over that period would have been equivalent to approximately 160t.

Silver activity over the same period has been the other way round, with only five days of creations and a net redemption of 420t and a net dollar outflow of $341M. While the markets may have had some clear leadership from the Fed in terms of interest rate policy (and the focus is firmly on inflation given that the “full employment” element of the dual mandate is now more or less achieved) the potential impact of the war on supply chains and economic activity has undermined sentiment in silver. The gold:silver ratio has thus widened again, in the short term at least, and is now at 77. The overall downtrend in the ratio, however, reflects the bull phase of the past three months.

While the ETFs are moving in different directions, the Commitments of Traders activity on COMEX, which is recorded as far as last Tuesday 15th March, shows a speculative retreat in gold, albeit a small one, with some further profit taking and neutral short-side activity. Silver also saw some profit taking, but there was also some short covering. There are also indications now that the Asian markets, so quick to retreat from high prices earlier this month, are coming back on a bargain hunting spree which, combining with the geopolitical background, should aid a period of consolidation. On balance, the tailwinds for gold are stronger than the headwinds, while silver faces more of a struggle.

Gold, Silver and the Ratio