Aug 2021

Aug 2021

Gold more resilient than the headlines suggested last week

By StoneX Bullion

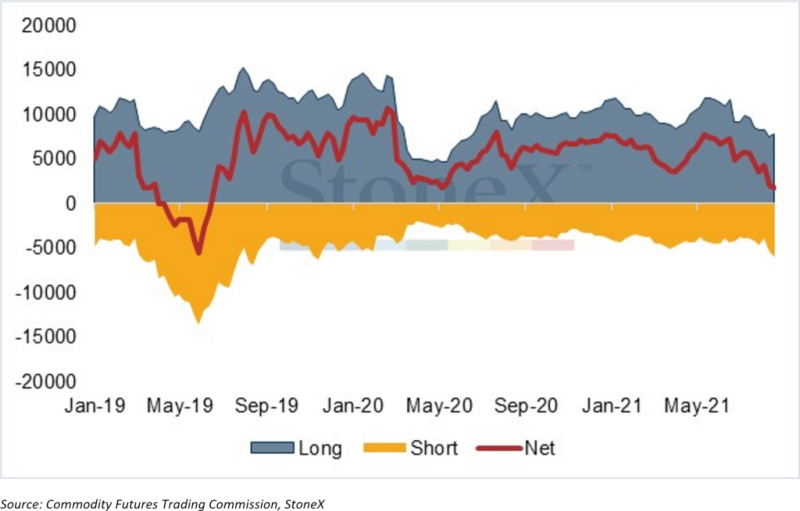

Last week we were looking back at the heavy fall, subsequently unwound, in gold the previous Monday in the so-called “flash crash” which took over $100 or just over 1% off the price. The CFTC numbers for Commitment of Traders, released on the Friday of that week, relate to a trading week ending on Tuesday so the COMEX reaction was reflected in those numbers. We thought that the subsequent week would see substantial short covering in gold and silver; we were right about the former, but wrong about the latter – in fact, silver shorts (this is among money managers, not the commercial side of the market) increased in the following week as the market’s industrial side took precedence over the precious aspects of silver’s fundamentals.

To that end, the concerns last week over the persistence of the virus and its economic impact, notably with economic numbers showing continued slowing in the rate of growth in China and consumer confidence weakening in the both the United States and Europe, have been putting pressure on commodities overall. The Bloomberg base metals index, for example, dropped by 5.6% between last Monday 16th and Thursday 19th August before a small rally towards the end of the week. Silver came down over the same period, although the proportional fall was smaller, at 3.7%, suggesting some mild supportive influence from steady gold.

Those Commitment of Traders figures (to close of business 17th August) showed fresh longs and fresh shorts in silver, with the net long position dropping to 1,770t, the lowest since mid-June 2019 and compares with a twelve-month average of 5,963t. Gold saw a small increase in outright longs, but outright shorts dropped substantially, from 238t to 181t – although, with the exception of the previous week, this is still the largest outright short since mid-May. The net long stands at 184t, after 110t the previous week and compared with a twelve-month average of 255t.

Market conditions have been quiet, as befits mid-August, with many participants away from their desks. While this might normally lead to volatility, uncertainty is generally deterring participants from taking positions, preferring to let conditions settle until the outlook is clearer.

This week sees the Jackson Hole symposium, an annual gathering of central bankers and which normally takes place in Kansas City; this year it will be staged virtually. The Minutes of the Federal Open Market Committee July meeting last week were more hawkish than the month previously, with risks around the inflation protection “tilted to the upside”, whereas in June they were seen as “roughly balanced”; members of the Committee are prepared to adjust the stance of monetary policy as appropriate “in the event that risks emerged that could impede the attainment of the Committee’s goals”. In June the stance was that Members expected to maintain an accommodative stance of monetary policy until the dual mandate was achieved. Fed Chair Jay Powell addresses the Symposium on Friday, and the markets are already looking forward towards that date. The September meeting of the FOMC, which is the next meeting at which economic projections are published, is scheduled for 21st and 22nd September. Until then, the markets will remain on edge, monitoring any speech from central bankers around the world and keeping a close eye on the state of the pandemic.

Managed money positions in the COMEX silver contracts

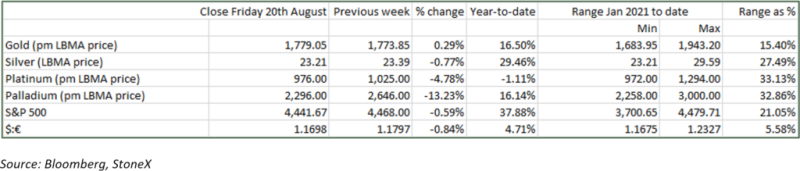

Gold, Silver and the Bloomberg Base metals Index