Sep 2021

Sep 2021

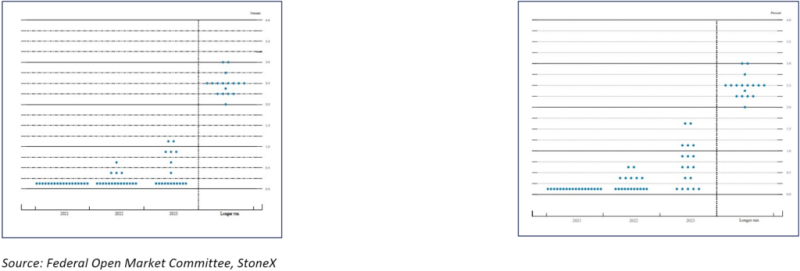

Gold heavy falls last week and this week will be nervous

By StoneX Bullion

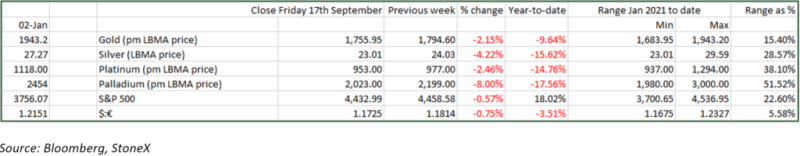

The much-awaited next meeting of the Federal Open Market Committee is this week, the 21st and 22nd of September and the tone is becoming increasingly hawkish. As we noted last week, this meeting is one of the four during the year in which economic projections are published, including the “dot plot” which charts each member’s expectation for the level of the federal funds rate at the end of this year, next year, and thereafter.

We also noted last week that, “these markets, barring an exogenous shock, are likely to remain range bound until the FOMC meeting. Although it has been a topic of conversation for weeks, it will, nonetheless, be a key driver for market direction in the near term”. Well the middle of last week saw a series of bearish technical signals hit the market and as gold duly slipped below the psychologically important $1,800 level (again), momentum and technical selling kicked in. This was underpinned by good manufacturing and retail sales numbers in the United States and a strong reading from the Bank of New Yok’s general business index.

Gold duly tumbled, losing $59, or 3.3%, in the space of just 24 hours. Ordinarily we should expect some bargain hunting into a fall like this, but the Asian markets remain very quiet and even the Chinese market stood aside. This is partly because the mid-Autumn holidays in China are at the start of this week, and then the week-long National Holiday starts on 1st October. Over and above that, however, the markets are now having to cope with the crisis at Evergrande.

China Evergrande Group is described as a multi-industry and digital technology enterprise, and owns, among other things, real estate development, new energy, property services and other enterprises; it is in fact the world’s most heavily indebted developer. The company has hit a major liquidity crisis and has been behindhand in meeting its debt obligations. With the Chinese Government trying to take the heat out of the property market over the past months, liquidity has been drying up and the Chinese Government has told local banks that the next set of Evergrande’s interest payments, due today, will not be met. Evergrande is on the verge defaulting on bank loans and potentially of collapse, in a situation reminiscent of the Long-Term Capital Management crisis of 1998, which saw a government bail-out (unlike the “Minsky moment” of the Lehman Brothers collapse, which was of course met with the opposite policy from the Fed in order to shore up the banking system). As we write (Monday 20th September) the Chinese markets are closed, so the contagion has spread through into Hong Kong and markets overall in are firmly in risk-off mode. All eyes will be on China when the markets re-open tomorrow; the balance of probabilities suggests that the Government will not allow Evergrande to implode, but then again there is always the possibility that it will make an example of the company and the effect of its over-borrowing. How this will be navigated will be a centre of attention this week, even taking some of the FOMC’s spotlight.

At the start of the week this kept gold under pressure as the dollar asserted itself as the primary safe haven, but the metal is now being bid higher as some bargain hunting and additional risk management develops.

As far as the FOMC is concerned the markets are already prising in an increasingly hawkish tone and expecting a rise in U.S. bond yields. The Statement and Jay Powell’s Press Conference are due mid-afternoon East Coast time on Wednesday. Then on Thursday Evergrande is due to make two further dollar-bond payments, which must be in doubt; and in the latter part of the week we also have the United States resuming its debt-ceiling negotiations.

As if that weren’t enough, we have a large array of central bank meetings this week including: -

- The Fed

- The Bank of England – potentially dovish in the face of stagflation fears

- Bank of Japan – rates expected to be held steady

- Norgesbank – rate hike already signalled

- RIksbank likely dovish despite inflationary pressures

- Swiss National Bank dovish, aiming to keep the Swiss franc strong

Unsurprisingly, silver has continued to underperform gold in these nervous days and the ratio is heading towards 80, the highest since late November last year. Once the dust has settled and some confidence returns, it could well start to narrow.

The Fed’s dot plot”, March and June

Gold, Silver and the Ratio