Dec 2022

Dec 2022

CoinInvest round-up Monday 19th December 2022

By StoneX Bullion

Bull case building for gold?

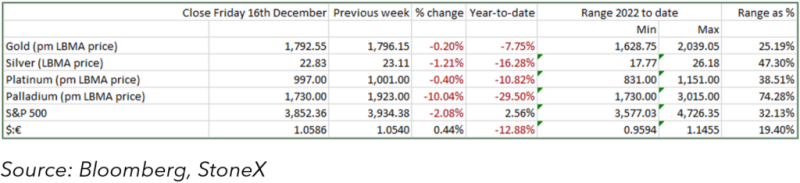

It was all about the central banks last week, with 50 basis -point rate hikes coming from the Fed, the European Central Bank, and the Bank of England. They are all three coming from different points of view, with the European Central Bank taking a very hawkish tone, the Bank of England sending mixed messages with a wide diversity of views from the Committee and the Fed reiterating its intention to contain inflation even if it does mean a recession. Overall, the winner was the euro.

Yields on American bonds came down over the week and helped to support gold, which is again challenging $1,800 as we write. We still believe that stagflation is the most likely outcome for the European and American economies over the foreseeable future, which remains supportive for gold, and by extension silver, and the bond markets continue to take a more benign view of the outlook than the Fed.

Gold’s action last week was lively, with a very sharp spike on the weak Consumer Price Index number from the States on the day before the release of the Fed’s statement and dot plot (see below), running up from $1,785 to $1,823 in a couple of hours, but this was unsustainable; the move was far too swift and took gold well into overbought territory, and the price-elastic consuming countries in Asia fled the market. Gold corrected towards $1,800; this then also gave way as the dollar regained some poise in mid-week as the markets mulled the implications of the Fed’s continued hawkishness. The $1,780 level does appear though to be sustainable as a support level and it is clearly arguable that gold has spent much of the past six months forming a base. The markets’ views are mixed about the medium-term direction of the dollar, with cogent arguments both from the bulls and the bears. If the United States does go into a recession, which looks likely and certainly does not appear to perturb Fed Chair Jay Powell unduly, then the argument would tend to favour the bears. While inflationary forces are also abating to a degree, the jury is still out on this issue also, especially given the energy crisis and the backdrop of continued conflict in Ukraine.

These factors taken together build a bullish argument for gold.

Meanwhile after spending much of the year concentrating on its industrial side and therefore moving in line with copper, silver has reasserted its precious metal characteristics and briefly traded over $24 when gold was spiking in the wake of the CPI figure. Here, too, the market was overbought, and silver corrected and is now looking to stabilise between $23.0 and $23.5, with the gold: silver ratio standing at 77, having been as high as 95 at the start of September. Rallies in gold are frequently half-hearted if not accompanied by silver – and a change in trend often starts with silver rather than with gold, due to its lower unit price and higher volatility (and it is a much smaller market). Demand for sliver coins remains very strong and this is expected to continue well into next year.

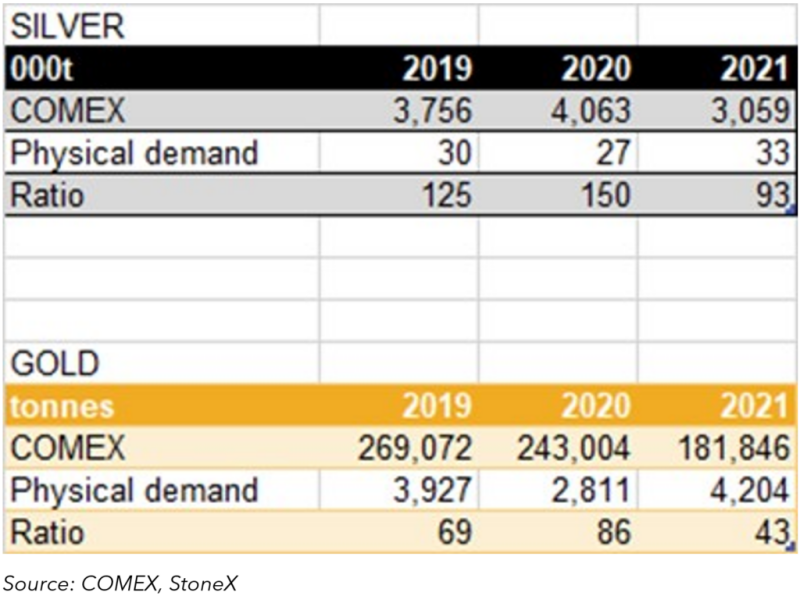

Elsewhere at the retail level the prospect of a rebound in the Chinese economy, although it may be some months before it gains traction, is likely to help bolster physical gold demand. This of itself would never be enough to drive prices higher but the support that it gives the market can then encourage professional interest, which is much more influential. This is illustrated by the relative sizes of the physical and the futures markets: for example, these tables show COMEX turnover (just COMEX, none of the other futures exchanges) expressed as a multiple of global mine production.

The latest figures from the CFTC, referring to the week ended last Tuesday (the day of the spikes in prices), shows fresh longs and short covering in both gold and silver, with gold’s net long now at the highest since mid-August while silver’s is the largest since early May.

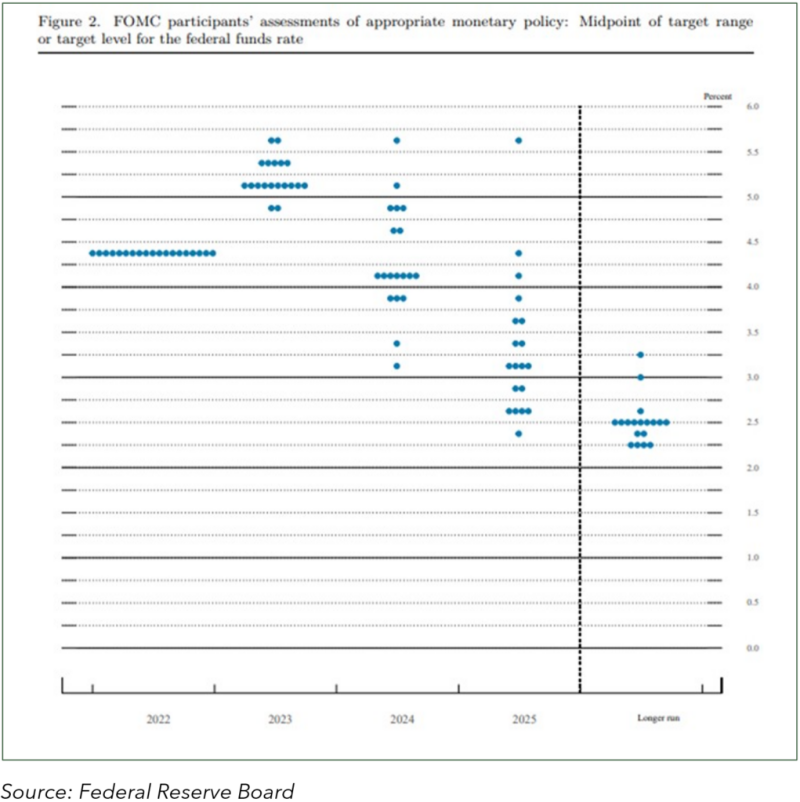

Finally, back to the Fed: - the latest dot plot, which is the level at which each Committee member expects fed funds to be at the end of the next two years and beyond., is essentially some 75 basis points higher than it was in its previous iteration, in September,

FOMC December dot plot

Key charts

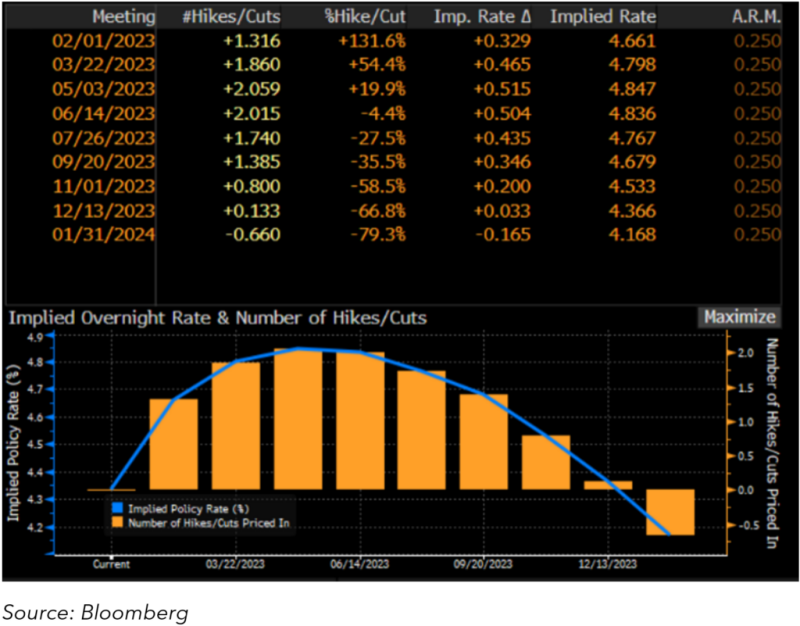

US fed funds rates and projections; peak target now back out to June at 4.85% against 4.99% a week ago.

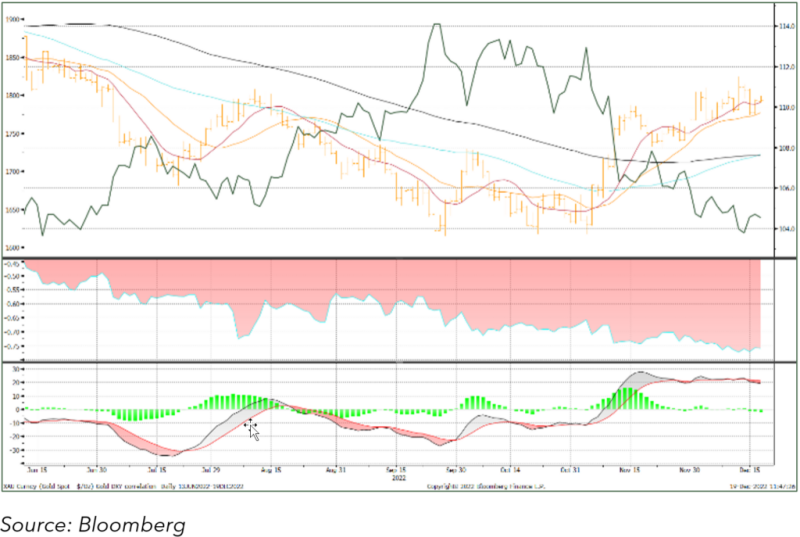

Gold, the dollar and their correlation

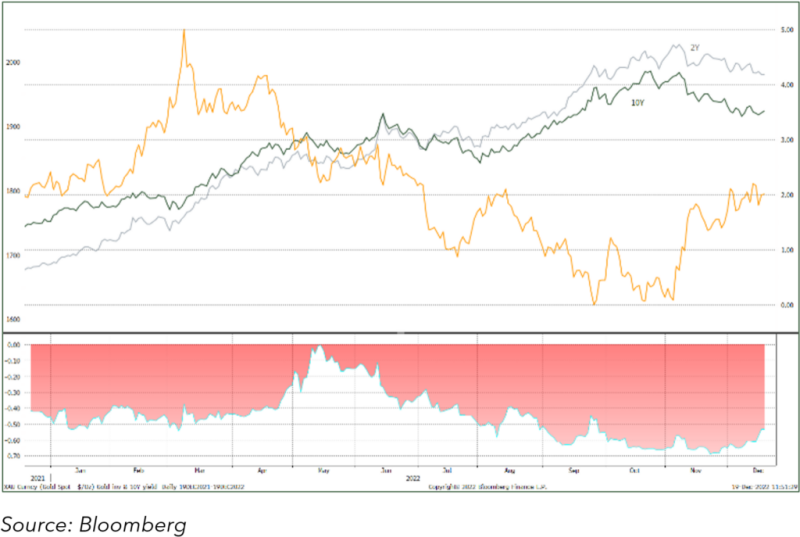

Gold and the two and ten-year yields; correlation with the 10Y

Gold and the S&P; ratio