Oct 2022

Oct 2022

StoneX Bullion round-up Monday 31st October 2022; all eyes on the Fed – again (still)

By StoneX Bullion

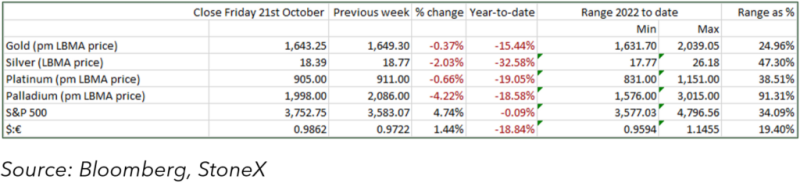

Disappointing US numbers last week and at the end of the previous week have raised talk of a Fed pivot sooner rather than later. When it comes to market sentiment, perception is everything so even if these suggestions are premature (which in our view they are), they will colour expectations regardless. As a result we saw the dollar come off a little in the early part of last week and gold maintained the rally that had been built on the period of price consolidation that developed over August and September, before easing latterly.

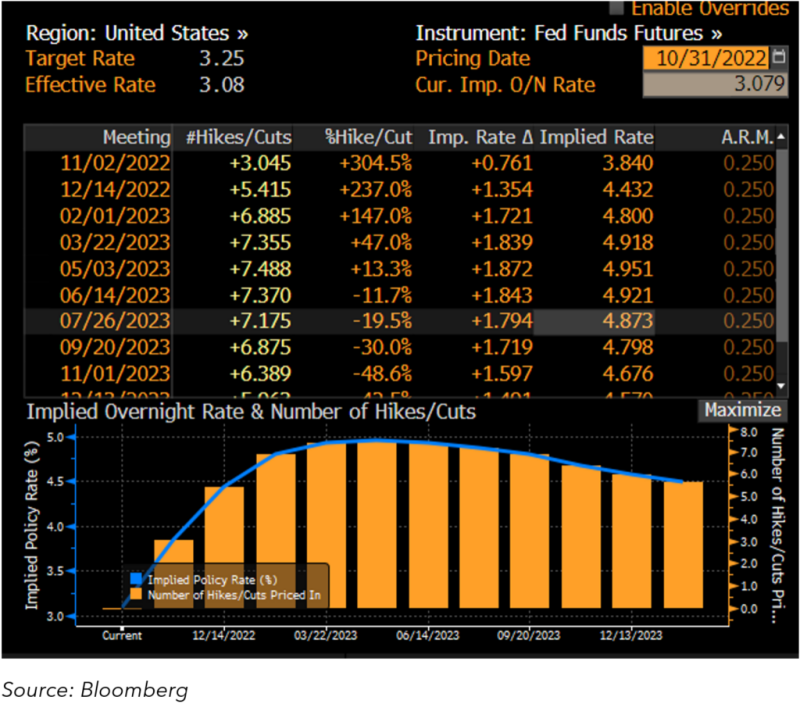

The Federal Open Market Committee (FOMC) meets this week on Tuesday/Wednesday 1st and 2nd November. The markets are fully expecting a 75-basis point hike in the fed funds target rate (current rate is 3.25%) and had been looking for a further 75-point hike in December, but that has now been pared back and the current projection is for roughly 60 basis point cut; this would suggest that the markets are pricing in a 70% likelihood of a 75-point cut.

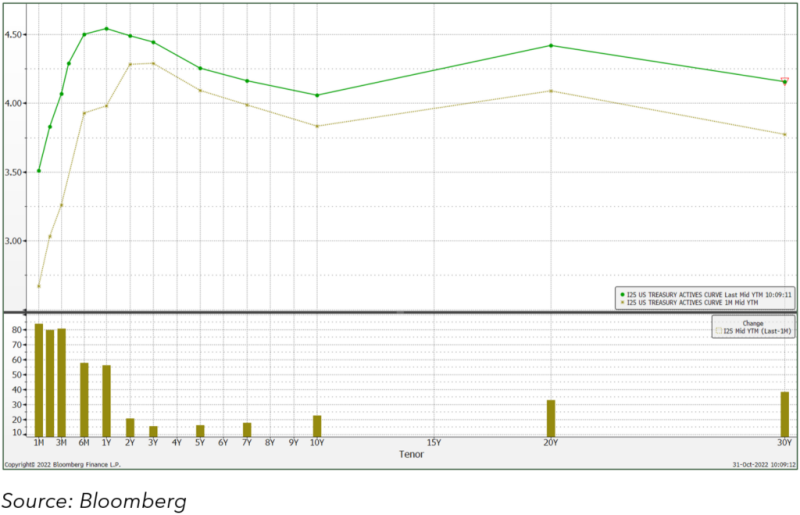

The chart to the right shows the U.S. yield curve, that of a month ago and below, the change. Clearly the short tenors have risen by a lot more than the mid-term, while at the long end, yields are up by a little more, with the 30Y (key for mortgages) up by almost 40 basis points over a month previously.

Background

US yield curves, now and a month ago

- Early in the week U.S. numbers posted a much lower Consumer Confidence figure than expected and the “Expectations Index”, at 78.0%, effectively reflects recession expectation. Wholesale and retail inventories were up mildly but here too the figures were below expectations, . The numbers suggest that inventories are still able to handle improved consumer demand, but the rate of increase is declining.

- Later in the week the GDP numbers exceeded expectations, the annualised quarterly figure coming in at 2.6%. The residential numbers were still pretty awful (although rents are shooting up as new homes sales sink). Motor vehicles were still weak. Regional manufacturing numbers were also pretty shocking, though, which could point to a modification of the Fed’s cycle; but the PCE Deflator, which the Fed watches closely, was 6.2% and this points the other way. So the jury is still out.

- In Europe the economic confidence numbers were below 100, reflecting in part the geopolitical circumstances that are exacerbating energy and grain issues, for example. The CPI index was 10.1%, with dairy up 24% and fats & oils by 28%. Electricity gas and fuels were up 70% while liquid fuels doubled. The European Central Bank meeting resulted, as expected, in a 75-point rate hike and gave minor boost to the euro, but the currency remains in a downtrend.

Metals

- Gold started drifting lower in mid-week, having reached a two-week high in dollar terms, testing $1,675. The US GDP figures prompted further selling from the professional market, taking prices back towards $1,640.

- while physical demand in India and the UAE was heathy last week during the Diwali Festival, which is seen as the most auspicious day for gifting, especially gold. The Middle East has been very busy, both for investment-grade jewellery and investment bars, but the festival is over and the markets have eased. South-east Asia is relatively quiet.

- Silver was also busy during Diwali and has continued to benefit from the implementation of the import tariff on gold into India that wasn’t extended to silver bullion.

Gold and silver, 2022 to date

Market developments

- In the background the gold Exchange Traded Products are still under pressure. Much as last week, we saw one day of net creations (0.76t), but the rest of the time has seen redemptions, with the result that since the start of September holdings have dropped by 146t to 3,504t. Over the year the net change is a decline of 84t, continuing to extend the reverses from the strong gains driven by U.S. and European purchases in the wake of the invasion of Ukraine.

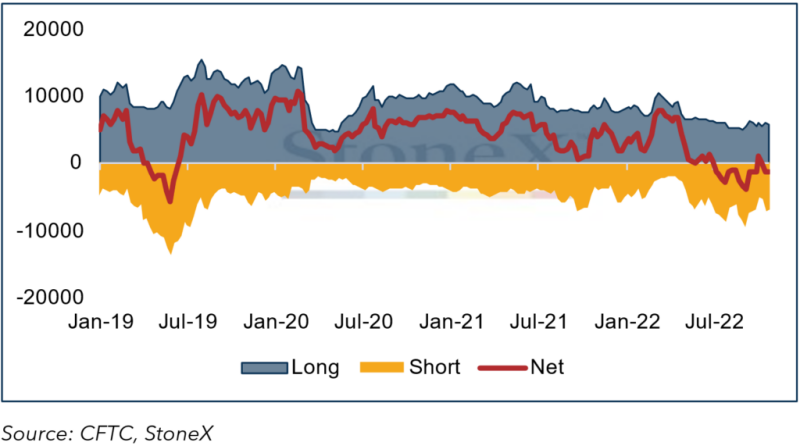

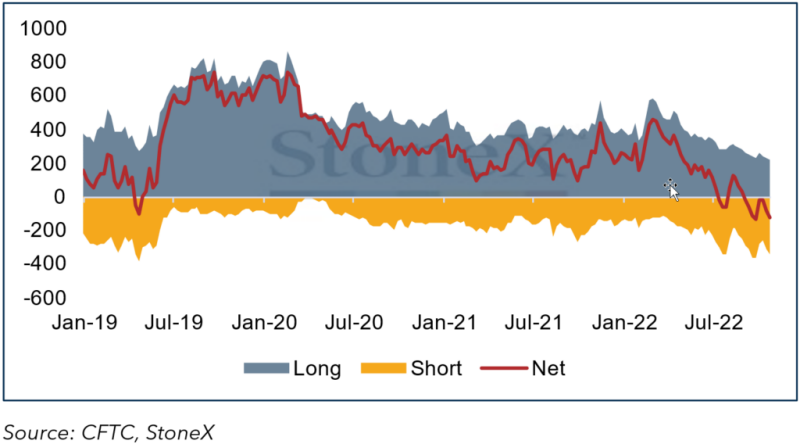

- In the seven days to 25th October, the most recent reporting date from the CFTC, gold had dropped sharply and then rallied to end the period more or less unchanged. Among the Money Managers on COMEX, the gold contracts saw very light long liquidation but relatively aggressive fresh shorts, taking the net position to a short of 41t, against a twelve-month average of 179t.

- In the same period, silver saw a reduction on both sides, with the result that the net position changed by just one tonne, to a short of 1,241t, against a twelve-month average of a 2,031t long.

- Meanwhile since end-September gold open interest on COMEX has increased notably, while inventories have come down 17t to 778t, comprising 53% of total open interest. In the silver contracts, open interest has increased by just 19t to 21,478t (a year’s global industrial demand is roughly 26,000t); inventories, at 9,368t,are down by 90t and still comprise 44% of total open interest.

Key charts

Gold in dollar terms, year-to-date; technical indicators. Still out of the downtrend and currently under pressure from the 10D and 20D moving averages

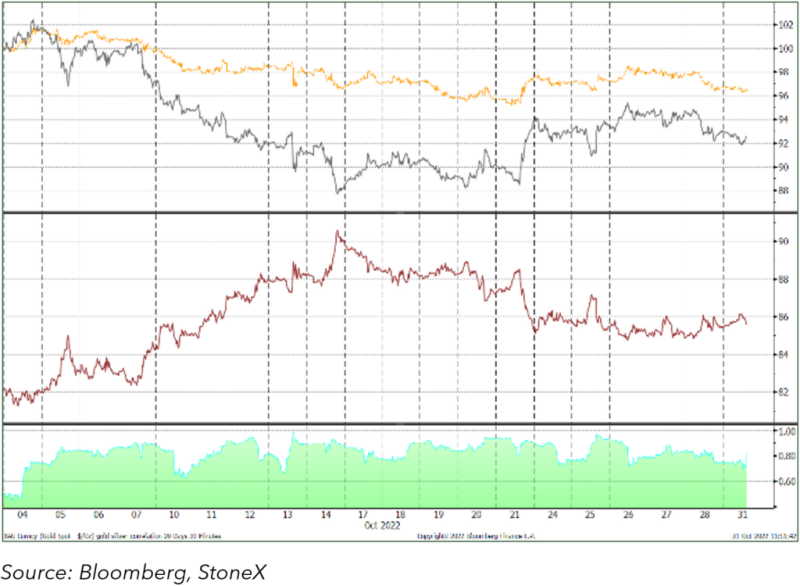

Gold, silver, the ratio and the correlation

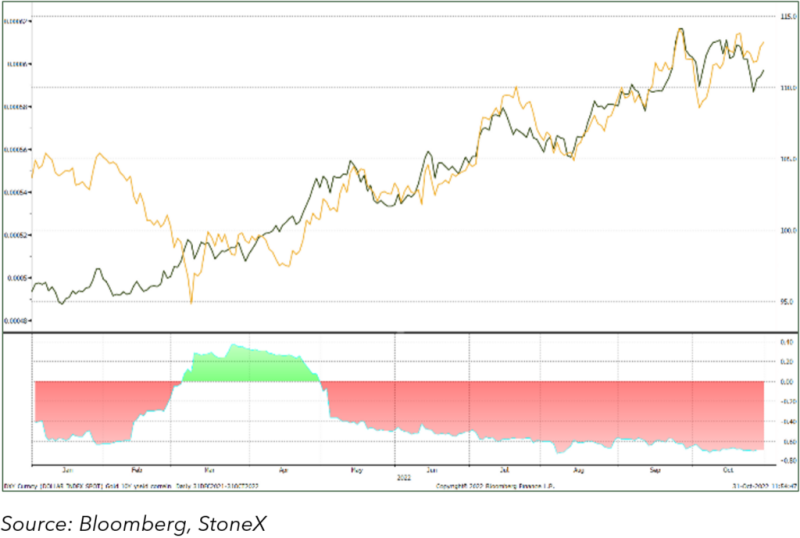

Gold (inverted) and the ten-year yield

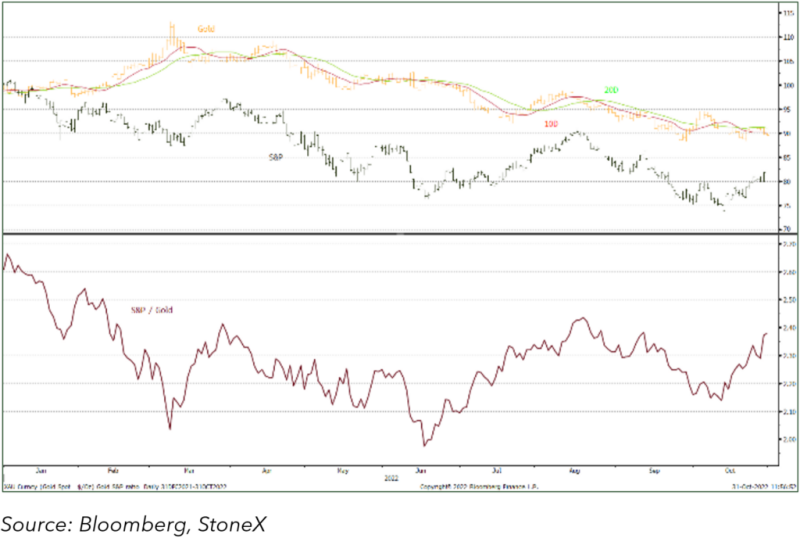

Gold and the S&P; ratio

Gold and silver COMEX positioning, tonnes

Gold: -

Silver: -