Aug 2022

Aug 2022

StoneX Bullion round-up Monday 22nd August 2022

By StoneX Bullion

- Fresh falls for gold and silver

- Possibility of Iran oil deal may reduce geopolitical risk

- Jerome Powell addresses Jackson Hole this week as FOMC members turn more hawkish

- People’s Bank cuts rates again in fight to bolster the Chinese economy

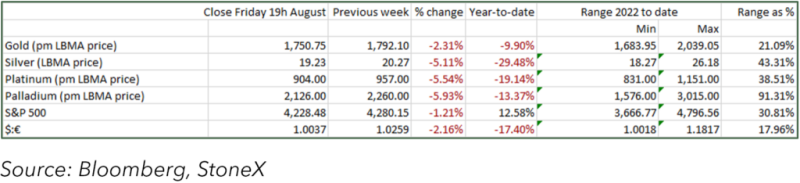

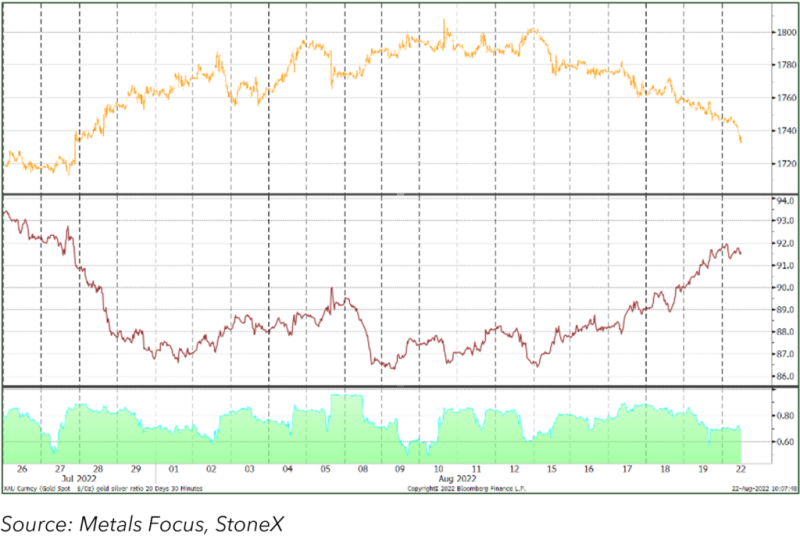

Gold has continued to slip lower over the past week, and as we write is trading between $1,730 and $1,735. Silver is below $19 and the ratio has widenerted markedly over the past week.

There is a variety of factors at play here. The dollar’s strength is clearly a driving factor as Federal Open Market Committee (FOMC) members appear to be turning hawkish again, after the Minutes from the late July FOMC meeting, released last week, were interpreted to be marginally more dovish than previously. The Governor of the Federal Bank of Richmond, for example, said last Friday that the Fed was determined to get inflation down to 2%. While he was of the view that this could be done without affecting economic activity greatly, he did acknowledge that a “recession could happen in the process”.

The FOMC has dropped its previous policy of offering forward guidance and is stressing the need for decisions to be data-dependent. One of the results of this is uncertainty in the markets, given that there is clearly a range of opinions in the Committee about how aggressive it should be at its September meeting (20-21st). Major hawk James Bullard (St.Louis) is arguing for another big move, while the dovish Kansas City member Esther George is more conservative.

Gold, silver and the ratio

Meanwhile the continued stresses in the Chinese economy have seen the People’s Bank of China make another cut in its prime rates. The one-year rate has been reduced to 3.65% from 3.70%, and the five-year rate (which is the mortgage benchmark) came down to 4.30% from 4.45%. This is the first one-year cut since Janaury, while the five-year rate was reduced last week also. The porpoerty martket is struggling in China and there are now widespread mortgage boycotts. The lack of consumer confidence is affecting the phsyical gold market. With the weaker yuan offshore exchange rate at the start of this week, gold prices went to a $15-20 dollar premium over the international market, but this was a currency move. The physical market is quiet as individuals are looking to save rather than spend and the younger population, when it buys jewellery, is tending to be carat material rather than the more traditional Chuk Kam (“yellow gold”), which is 99.99% (“four nines”) pure. While the latter is seen as an investment, carat jewellery is less price-elastic and seen more as adornment rather than investment.

On the Exchanges, in the week to 16th August when gold had just failed at $1,800, there was light liquidation and a very small increase in outright shorts; in the silver market there was more long liquidation and also some short covering; the overall impact was a small increase in the net long position, but nothing of any great note.The net gold long stood then at 113t, against an average over the previous twelve months of 221t; the net silver short was 979t against a net long averaging 2,665t over the previous twelve months.

Silver Commitment of Traders; Managed Money positions to 16th August; tonnes

In the Exchange Traded Products, gold has continued to see redemptions, although there was some slight bargain hunting at the end of last week after the fall towards $1,750. The net change so far this year is +108t to 3,680t, while the decline from the 22nd April peak of 3,889t is 209t.

Gold; technical indicators