Jul 2022

Jul 2022

StoneX Bullion round-up Monday 4th July 2022

By StoneX Bullion

Still sluggish and the gold:silver ratio hits near two-year highs

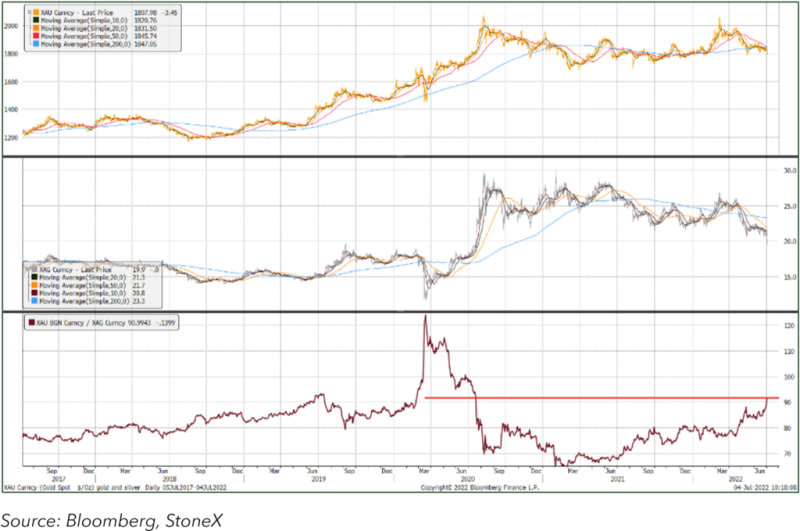

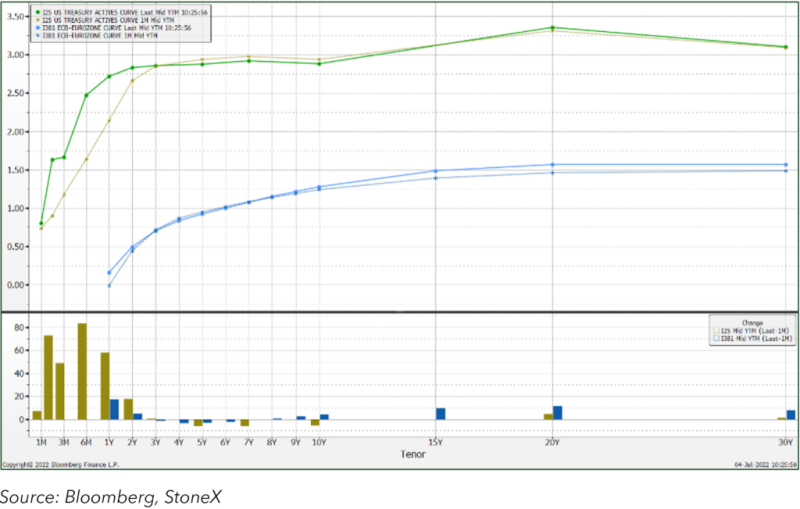

Gold and silver have remained under a cloud in recent weeks with little interest from the bulls, and under light pressure from the bears. As a result gold briefly slipped below $1,800 towards the end of last week, but has managed to clamber back above that psychologically important level. Increasing concerns over the prospect of a recession in the United States, possibly a prolonged one, and the likely spill-over effect into an already fragile Europe, has seen U.S. medium-term interest rates flattening off, although the short-term profile has remained quite aggressive amid mixed rhetoric from different members of the Federal Open Market Committee (FOMC).

The U.S. and EU yield curve, latest and one month ago

The next FOMC meeting is on the 26th and 27th of this month. This is not a meeting that produces economic projections, but it will still be closely watched. The current atmosphere is distinctly hawkish but with Fed Chair Jay Powell now starting to hint at fears of a recession, the next interest rate hike may not be 75 basis points, but 50. The Minutes of the most recent meeting will be released this Wednesday 6th July.

In principle this would be bullish for gold as it points to economic uncertainty, but market sentiment is facing in the opposite direction. The gold positioning in the Managed Money sector of the CFTC’s Commitment of Traders showed some bullish signs two weeks ago, but reverted to a bearish tendency last week (to the 28th June), with small long liquidation but some sizeable fresh shorts, taking the net long to its lowest level since early last October. In the silver market sentiment is persistently bearish in the professional sector, with the COMEX net long now down to 120t. Shorts have been increasing since mid-April, having grown from 1,999t to 6,156t last week; this latest figure compares with the average over the precious twelve months of 4,553t. Given silver’s notorious volatility, if we do encounter a short-covering rally it could well be a very sharp move.

For the time being, however, economic concerns are hanging heavily over silver and keeping prices under pressure. Coin demand remains strong, but Exchange Traded Products are still seeing redemptions, in both gold and silver.

Also helping to keep a cloud over gold is the news headlines suggesting that U.S. President Biden may ease tariffs on some Chinese imports, partly as a result of the inflationary forces in the United States, but no timescale has yet been released.

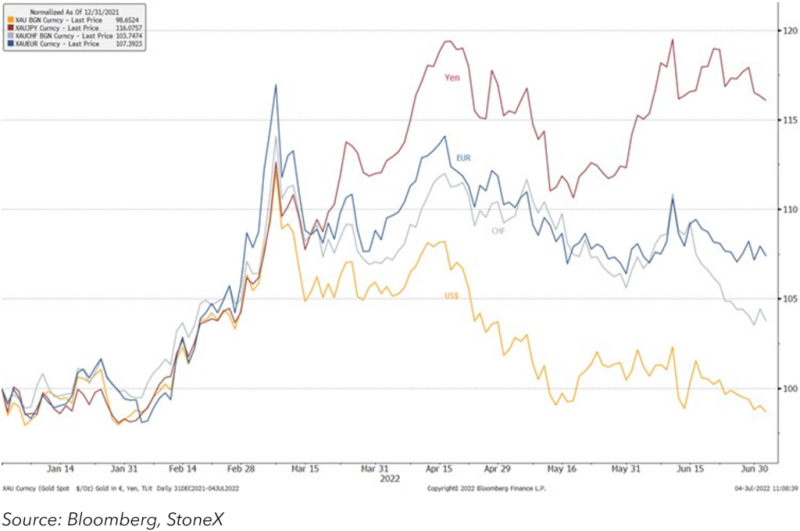

Gold prices in local currencies

At the retail level there is good demand for silver in India, but the gold market is still dormant and has been unnerved by a recently imposed 5% increase in gold import duty. In China the effects of the COVID virus are still being felt and that, combined with high oil prices and consumer caution, mean that purchasing there is also low. This does mean that there will be a lot of pent-up demand eventually, but for the time being conditions remain sluggish.

The gold, silver prices and the ratio