Jun 2022

Jun 2022

StoneX Bullion round-up Monday 20th June 2022

By StoneX Bullion

Gold holds steady while all around it fails

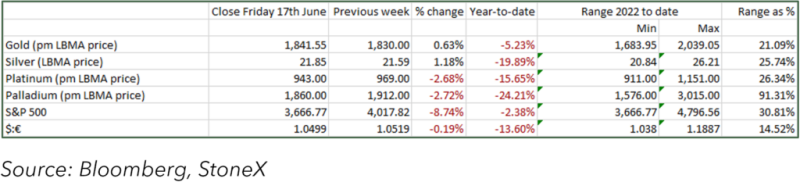

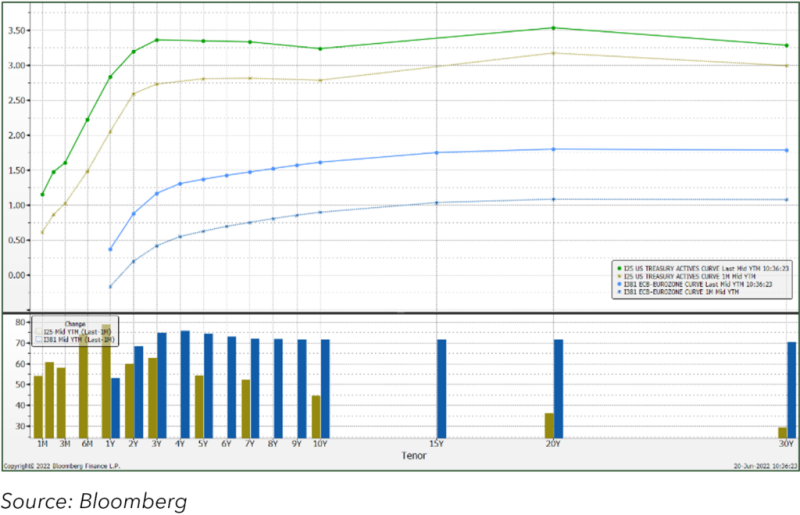

Last week, with the Federal Open Market Committee front-loading rate hikes and the European Central Bank holding an emergency meeting only one week after its scheduled June meeting, equity markets plummeted with the S&P 500 losing almost 9%, although the European markets, while still in the red, were better performers, shedding up to 4% in the case of Switzerland, but more generally dropping by between 2.0% and 2.5%. In fact, the fall started in the previous week, with markets becoming jittery over the increasing likelihood of a 75-basis point rate hike from the Fed.

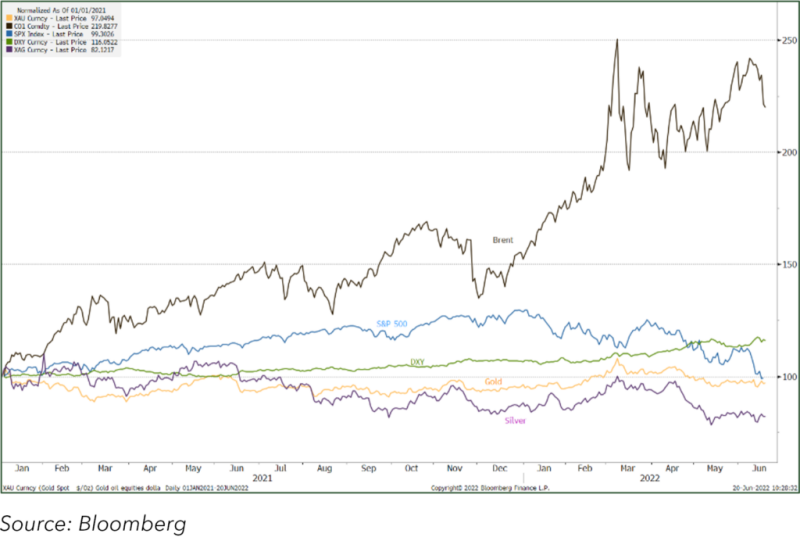

Gold:S&P ratio, 1st January 2021 = 100

Conditions are better at the start of this week, with stocks posting small gains. Despite this prior activity, there was the (almost inevitable) knee-jerk reaction when the announcement was made.

Gold, silver, S&P, dollar, Brent

Fed Chair Powell is aiming to get the biggest hikes out of the way now, in order to give the Fed some flexibility further into the future; and it is possible that, with the balance sheet run-off starting on 1st July, there may well be some natural buoyancy in bond yields because the buyer of last resort has now left the market; this will rumble on in the background, while the blunter instrument of rate hikes will continue to command the headlines.

Gold, meanwhile, traded steadily on a 4% range centred on $1,835 and is finding a degree of bargain hunting on any approach to $1,800. There have been several questions recently as to “why isn’t gold higher, given the geopolitical circumstances?”, the most likely answer to which is that “if it weren’t for Ukraine, it would probably be lower”. Certainly, the addition of 213 tonnes into Exchange Traded Products in the seven weeks following the invasion, for a net dollar inflow of $13.6Bn, was concentrated in the UK and Germany, which illustrates that much of it was based on political risk-aversion. Since then there has been some erosion of gold ETP holdings as the war has become part of the accepted backdrop for now, at least, and from the late April peak of 3,889t the holdings have decreased by 67t to stand at 3,822t. Global gold mine production stands at approximately 3,640 tonnes.

In the pre-Volcker days, it was usual for inflationary forces or expectations to boost gold prices, but with monetary policy firmly in the markets’ crosshairs, interest rate policy tends to be a key driver and this has certainly been the case of late. Silver continues to underperform slightly; the prevailing economic uncertainties, which tend to benefit gold, are not taking gold prices higher because concerns over interest rate policy (although in the longer term this argument may be thrown in to reverse if weaker economies start to struggle). As such, therefore, silver is looking more to the industrial outlook. As roughly 75% of silver supply is not price-elastic, being either a by-product of base metal mining or industrial scrap, it keeps on coming.

US and EU yield curves 20th June and four weeks previously

Where demand is still extremely strong, though, is in the coin sector. Major Mints are still on allocation and premia have been very high. So if Silver Eagle sales, for example, look disappointing, this is not because of a lack of interest; quite the opposite.

Meanwhile the Managed Money gold positions on COMEX in the week to 14th June (when gold slipped from $1,850 to $1,818) saw a big bearish swing. Having been as high as 514t in mid-April, outright longs have slid heavily, and stood at 339t last Tuesday, a contraction of 34% while the outright shorts have risen by 75t or 50% over the same period, to reach 225t. The net position is thus now at 115t, the lowest since early October 2021 and 56% of the average over the previous twelve months. In the same week there was a small increase in outright silver longs, but a big jump of 850t (16%) in outright shorts, taking the net long to 1,609t. The silver price, as usual, dropped a lot more than gold, with a 6% drop from $22.28 to $21.05 against gold’s 2% decline. Since then, silver, too, has found some bargain hunting and no doubt additional short covering. Silver has resistance at $22, and gold has migrated back to $1,840. Both metals have effectively been in narrow horizontal trading bands since mid-May and building up a head of pressure. Both have overhead resistance form the short-term moving averages and while the fundamentals favour the upside to a degree, the next move up may take some hard work. On the plus side, gold is trading narrowly above its ten-day moving average, but there is congestion reaching up to $1,873.