May 2022

May 2022

StoneX Bullion round-up Monday 9th May 2022

By StoneX Bullion

Gold:silver ratio at a 22-month high; manged money position net longs at three-month lows

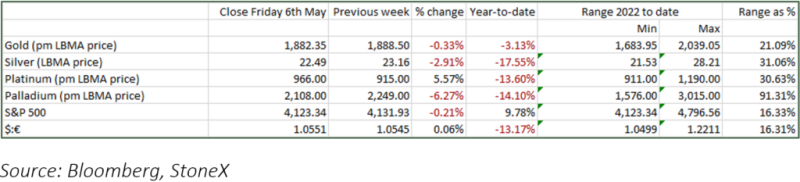

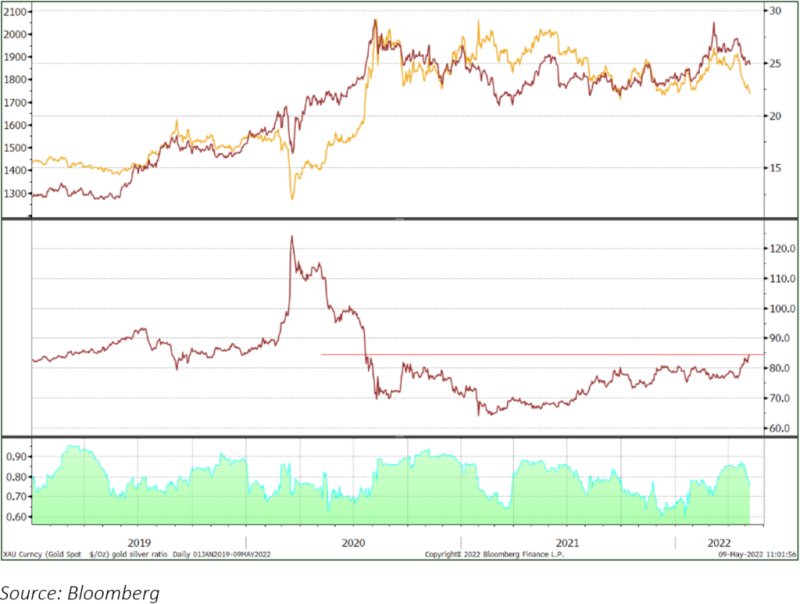

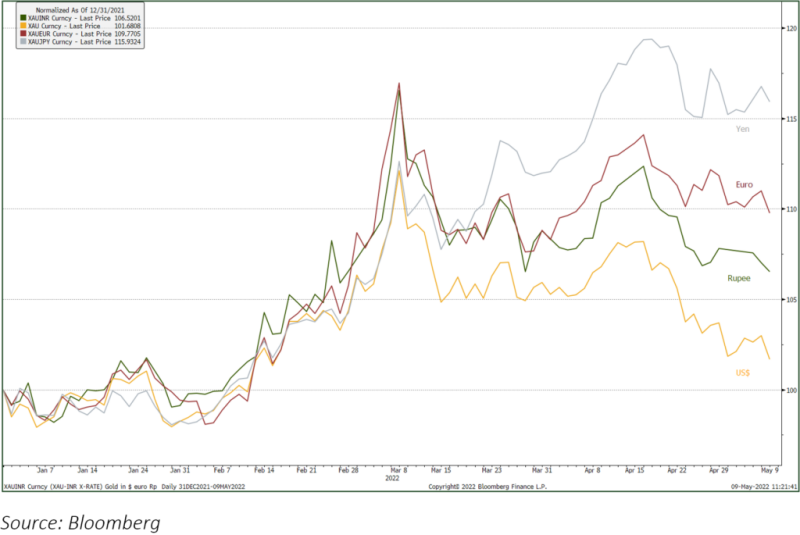

The weakened sentiment in the gold and silver markets has persisted, with prices drifting lower in several currencies, not just the dollar, reflecting a broad softness in the market. Silver was already underperforming gold even when gold was rising in mid-April; this is usually a sign that the gold rally was unconvincing in the first place, but it also reflects the economic uncertainty in parts of the world and the fact that, without any investor interest, silver would be in a surplus this year, the tonnage roughly equivalent to 16 weeks’ global industrial demand.

The key driver here is once again the activity in the bond markets, where yields are continuing to work higher following the outcome of the Federal Open Market Committee meeting in the middle of last week. This may seem slightly surprising, in that before the meeting the bond markets were pricing in a 99%+ likelihood of a 50 basis point hike at the May meeting (which did happen, taking the fed funds target rate to 0.75-1.00%), but were also discounting a hike of up to 75 basis points in the June meeting (14-15th). This suggestion was squashed by Fed Chair Jay Powell after the meeting had concluded; in his press conference he said “Assuming that economic and financial conditions evolve in line with expectations, there is a broad sense on the Committee that additional 50 basis point increases should be on the table at the next couple of meetings. We will make our decisions meeting by meeting, as we learn from incoming data and the evolving outlook for the economy. And we will continue to communicate our thinking as clearly as possible. Our overarching focus is using our tools to bring inflation back down to our 2% goal”.

Gold, silver, and the ratio

The bond markets reacted sharply in the immediate aftermath of these comments, rising rapidly and thus putting some downward pressure on yields, but this was easily unwound the following day and as we write the five-year yield, for example, has been testing 3% this morning and the ten-year yield has touched 3.2%. The bond markets now appear to be looking further forward and thinking about the potential impact of a series of chunky rate hikes in mid-year, even if 75 basis point rises are now off the table. Also the Fed’s focus on providing clarity will be cramping gold to an extent as it takes an element of uncertainty out of the market.

Gold, local currency terms

In the background of course we still have the Ukraine situation that gives us the added ingredients of geopolitical risk and the knock-on inflationary forces from the associated oil price shocks. Theis will be giving some support to gold, but on balance market sentiment, among the professional money managers at least, remains under a cloud.

The market changes in the week to Tuesday 3rd May saw the outright long managed money gold positions on COMEX effect a 40-tonne bearish swing, with 30t (6.8%) of long liquidation and a t12t (also 6.8%) increase in outright shorts; this takes the net long to 211t, which Is the lowest since 15th February (when gold was pausing briefly during its strong rally) and compares with the previous twelve-month average of 268t. Exchange Traded Products have experienced redemptions in nine of the last ten trading days, for a net reduction of 24t and a net dollar outflow of $1.5Bn.

Silver followed a similar pattern, with long liquidation of 643t (9%) of long Managed Money positions and a 1,121t (39%) increase in shorts. This took the net position to 2,575t, also the ethe lowest since mid-February and compared with the previous twelve month average of 4,431t. The Exchange Traded Products, which have a higher retail component than do gold, have had five days of creation and five of redemptions over the same ten-day period, for a net fall of 57t, but this is just 0.2% compared with gold’s loss of 0.7%.

These changes illustrate that some speculative overhang has left both markets, reducing the resistance to fresh rallies but for the time being sentiment remains clouded.